What are tariffs in global trade?

Global trade allows countries from all over the world to access goods and services they would otherwise be unable to produce. Without it, nations wouldn’t be able to function effectively, so much so that every country in the world imports goods.

However, sometimes countries want to put restrictions on certain imports. To do this, governments apply trade barriers like tariffs on specific goods and services.

In this article, we’ll be looking into the different types of trade barriers that governments use, why they use them and how they impact businesses.

What are trade barriers?

Trade barriers are restrictions on the movement of goods between two countries. Typically, a country will place a trade barrier on imported goods. Although, restrictions on exports are used from time to time.

For the purpose of this article, we’ll be breaking trade barriers down into two categories: tariffs and non-tariff barriers. Governments use either or both depending on their goals.

What are tariffs?

Put simply, a tariff is a tax imposed by a nation on imported goods and services. In the UK, HM Revenue and Customs (HMRC) collects tariff fees which boost government revenue.

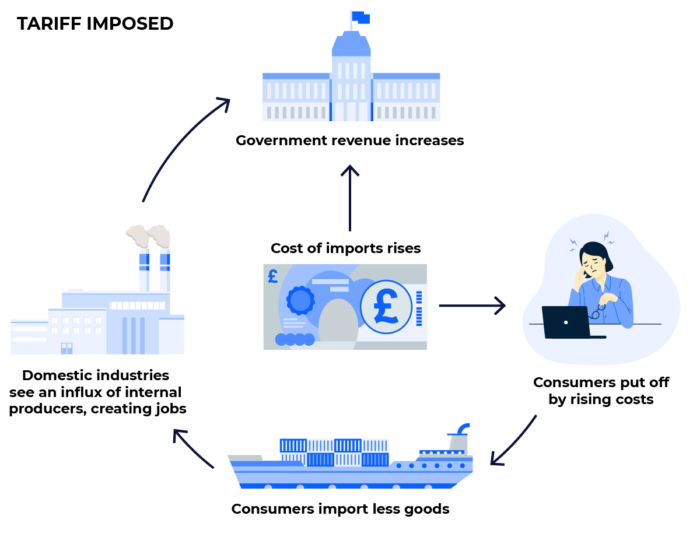

When governments impose tariffs, goods and services from abroad become more expensive for businesses and individuals. This makes them less attractive to domestic consumers.

Tariffs indirectly affect the exporting country as domestic consumers are put off by the rising costs. If domestic consumers still have an interest in the good or service, they will have to embrace the higher fees. These inflated prices are sometimes referred to as artificial prices.

Consumers also face the issue of less choice under tariffs. Restrictions on imports limit the variety of a certain good or service available to them. With less competition, the quality of output from domestic producers may drop. But that’s not always a bad thing.

Businesses at home may see the restricted good or service as an opportunity. The lack of competition from abroad may entice more domestic producers. This creates job opportunities and lifts domestic employment.

The diagram below shows the effects of higher import costs from tariffs.

Why do governments impose tariffs?

Governments use tariffs to raise revenue and protect domestic industries. Often, emerging economies want to encourage growth in infant industries. Advanced economies may also want to support developed industries.

Here are a few key reasons why governments impose tariffs:

Defend domestic employment

We mentioned earlier how job opportunities are created when more domestic producers are interested in restricted goods and services. But tariffs help to shield employment in other ways, too.

Domestic businesses in certain industries may find it difficult to compete with companies overseas that use cheap labour. As a result, domestic businesses may look to fire members of their workforce to cut costs. When tariffs are implemented, businesses can keep hold of their staff, thus protecting domestic employment.

Support infant industries

Many developing countries or emerging marketing nations use an economic strategy known as Import Substitution Industrialisation. In short, it means relying less on imports from developed countries.

Governments from developing countries may impose tariffs on goods and services in industries where they want to promote domestic growth. The higher import fees create a domestic market for the good or service. Businesses in the industry can thrive without the pressure of competitive pricing.

Protect the public

Sometimes, governments may consider certain goods to be dangerous to their population. For example, the UK imports fish from Iceland. If the UK government has reason to believe the fish is contaminated with disease, it may restrict imports to protect public health.

Retaliation

A government may introduce tariffs against another country if it believes certain rules or agreements have been broken. For instance, ‘Parmigiano Reggiano’ (mistakenly called parmesan all over the world) is protected by law in Italy. For a cheese to be bear the official name it must be made in certain areas of Italy.

If the Italian government believes the UK is allowing its domestic cheese manufacturers to call their hard cheese ‘Parmigiano Reggiano’, it may retaliate with tariffs. This could be restrictions on motor vehicle imports from the UK, for example.

Russia sanctions

Sanctions are another form of trade barrier that one country may use against another. Unlike tariffs, sanctions are primarily used to achieve foreign policy goals.

In March 2022, major world economies introduced trade sanctions on Russia after it moved military personnel into Ukraine. The purpose of the sanctions was to hurt Russia economically and encourage President Vladimir Putin to withdraw his forces.

Western nations such as the US and UK banned imports of Russian oil, natural gas and coal. The sanctions damaged Russia’s economy but caused global prices to soar. Consumers worldwide faced huge surges in the price energy, heightening inflation fears.

Western governments were prepared to hurt their own economic growth to achieve their foreign policy goals.

As of March 2025, these sanctions remain in effect, and their economic impacts continue to influence global markets.

Can tariffs be offset by exchange rates?

Tariffs on imported goods can affect your business if you trade internationally. Extra costs on imports can lose you money. But your businesses may be able to offset the extra costs if currency markets move in your favour.

International trade usually requires an exchange of currencies. Currency values rise and fall based on a variety of factors. If a currency value shifts in a beneficial way for a business, its international payments become cheaper, and it can offset some of the fees from tariffs.

Read: What are restricted and exotic currencies in foreign exchange?

Example of exchange rates offsetting tariffs

Let’s say a UK business makes cars and imports the majority of its parts from Japan. The business exchanges the pound sterling (GBP) for the Japanese yen (JPY) to make payments. At the time, the exchange rate between GBP and JPY is 152.50.

Without tariffs, the parts required for each car costs the business £5,000 or ¥762,500. The UK government decides to impose a specific tariff of £1,000 on car parts from Japan. Now, the business pays £6,000 or ¥915,000 to build one car.

During this time, GBP appreciates against JPY. This means one GBP now buys more JPY.

If we say GBP/JPY has increased by 525 pips from 152.50 to 157.75, it means the business only needs £5,800 to pay the ¥915,000 required for its car parts.

Therefore, GBP’s appreciation against JPY has saved the business £200 for each car. The saving shows how exchange rates can offset the additional costs of tariffs on businesses.

In this example, the business benefitted from fortunate market movement. But currency markets are volatile and can move in either direction.

With the right foreign exchange (FX) solution, businesses can capitalise on favourable opportunities and minimise the risks of the ever-moving currency markets from damaging their bottom line.

Privalgo’s Currency Specialists can help your business create an invaluable FX strategy to bring confidence to your currency costs and protect your profits. To find out more, request a callback and one of our Specialists will be in touch.

How do tariffs work?

Tariffs typically come in one of two forms: specific or ad valorem. A specific tariff is a fee added to one unit of a good, such as £1000 for each car imported.

An ad valorem tariff is levied based on a percentage of a good’s value. For instance, a 15% ad valorem tariff on Japanese cars imported to the UK means a £10,000 car would now cost the consumer £11,500. The price has increased by 15%.

How do tariffs affect prices?

Let’s look at how tariffs can influence prices, using global computer trade as an example.

Typically, the world price for a computer is lower than the domestic price. That’s because computers are manufactured globally, meaning there’s greater supply and more competition – which drives prices down.

If imported computers were more expensive than domestic ones, there would be no incentive to import them at all.

Now, if domestic manufacturers try to match the low world price, they’ll only be able to produce a limited number before it’s no longer profitable to compete.

But at these lower prices, consumer demand rises. People want more computers than the domestic market alone can provide, so imports increase to fill the gap.

When tariffs are introduced, this all changes.

Let’s say a tariff is imposed that makes imported computers more expensive. The world price effectively increases for domestic consumers.

In response, domestic production rises. With less pressure from cheaper imports, more local manufacturers enter the market.

At the same time, higher prices dampen consumer demand. People are less likely to buy computers when they cost more.

The combination of higher domestic production and reduced demand means the country now needs to import fewer computers overall.

In this case, the tariff has worked as intended: raising prices, reducing imports, and encouraging domestic production.

Read: Shipping container industry: Top 4 risk management practices.

Trump tariffs

In general, free trade is seen as a beneficial world development. It improves the quality and variation of goods and services for consumers and makes them cheaper, too. Also, businesses can trade with countries across the globe. But free trade does have its cynics.

Donald Trump’s first presidential campaign was critical of free trade agreements. In 2018, the Trump administration imposed tariffs worth billions of dollars on Chinese imports. China responded with tariffs on steel, pork and other goods imported from the US.

Towards the end of 2018, China went like for like with the US’s $16 billion tariffs on Chinese imports. It introduced $16 billion worth of tariffs on US goods including crude oil and motor vehicles.

The US also applied restrictions to steel and aluminium from the EU, Canada and Mexico.

Trump’s tariffs were the largest restrictions imposed by the US since World War Two. He had a variety of reasons for imposing his tariffs.

To name a few, he wanted to bring back jobs he felt had been lost to foreign countries, retaliate to tariffs placed by other nations on the US and balance the trade deficit.

In 2025, Trump took office for a second term and continued with a range of global tariffs. In April 2025, the president introduced a 10% universal tariff affecting almost all foreign imports into the US.

He also introduced ‘reciprocal tariffs’ for specific countries with significant trade surpluses with the US. These included:

- China: (34% tariff on imports, adding to previous duties and bringing the total levy to 54%)

- European Union (EU): 20% tariff on goods.

- Japan: 24% tariff on imports

- Vietnam: 46% tariff on goods

Additionally, a 25% tariff was placed on foreign-made automobiles, taking effect from 3 April. Canada and Mexico, while generally exempt from the new reciprocal tariffs due to existing trade agreements, may still face this 25% tax.

Read more about Trump’s tariffs in our article: How Trump’s tariffs could impact businesses in 2025.

What are non-tariff barriers?

Except for the Trump administration, tariffs have become irregular in modern-day global trade. Institutions such as the World Trade Organisation (WTO) promote free trade and create roadblocks for countries wanting to levy tariffs and taxes on imports.

Instead, countries have turned their attention to non-tariff barriers. Here are some examples:

Licenses

Governments restrict certain goods that require a license for importation. For example, a license is required to ship plants into the UK from abroad. These licenses are granted to specific businesses to limit competition. The result is higher prices for consumers.

Read: CBAM regulation: the guide for UK importers.

Import quotas

An import quota limits the amount of a particular good that can be imported. For instance, a government may apply an import quota to the amount of pork that businesses can bring into the country. With less pork available, but the same consumer demand, prices will rise.

Voluntary Export Restraints (VER)

Unlike the other trade barriers we’ve explored in this article, VERs are imposed by the exporting nation, not the importing one. However, they’re usually requested by the importing nation and are often greeted by a reciprocal VER. This is why they’re known as ‘voluntary’.

Let’s say Kenya limits its tea exports to the UK based on a request from the UK. As a result, the UK issues a VER on its machinery exports to Kenya. This hikes the price of tea and machinery but protects domestic industries.

Local Content Requirement

As we’ve established, one of the main goals of trade barriers is to protect domestic industries. So, a local content requirement on a good means a percentage of the good or the good’s value must be made domestically.

For instance, a local content requirement on the import of computers means 30% of computer parts must be made internally. On the other hand, the restriction may require 20% of the value of each computer to come from domestically produced components.

Conclusion: why trade barriers matter for international businesses

Tariffs and trade restrictions can have a huge influence on the global economy and carry real consequences for businesses trading across borders.

They might be used to protect domestic industries, influence foreign policy, or retaliate against trading partners. Regardless of the reason, these barriers can alter supply chains, increase costs, and change the way goods and services flow between nations.

As we’ve seen with the latest rounds of Trump-era tariffs and long-standing sanctions on countries like Russia, global businesses must be prepared to adapt.

At Privalgo, helping businesses navigate uncertainty is what we do best. Our Currency Specialists can help you manage currency risk, enabling you to take advantage of favourable rates and forecast with more confidence.

If your business is feeling the effects of tariffs, sanctions, or volatile currency markets, we’re here to help.

Get in touch with a Privalgo Currency Specialist to learn how we can protect your profits and support your global growth.

10 FAQs about tariffs and trade restrictions

Below are 10 frequently asked questions about tariffs and trade restrictions. Some answers use content already mentioned in this article.

What is a tariff in simple terms?

A tariff is a tax that a government places on goods or services imported from another country. It makes those goods more expensive, which can discourage people and businesses from buying them, and encourage them to buy domestically instead.

For example, if the US imposes a 20% tariff on China, it means US businesses will have to pay more for goods imported from China. To offset the additional costs, US businesses might look to source their goods from the US instead or other countries with no tariffs.

What is a tariff in the UK?

In the UK, tariffs are collected by HM Revenue and Customs (HMRC) on imported goods. These taxes vary by product type and country of origin, and are used to generate government revenue or protect UK industries from international competition.

Is a tariff a tax?

Yes – a tariff is a type of tax specifically applied to imports (and sometimes exports). It’s paid by businesses bringing goods into a country and can influence pricing, availability, and competition.

What is an example of a tariff?

A specific tariff example might be a £1,000 tax on every car imported from Japan into the UK. Alternatively, an ad valorem tariff might be 15% added to the value of imported luxury handbags from Italy.

Why do governments impose tariffs?

Governments use tariffs to protect domestic jobs, support local industries, raise revenue, or retaliate against unfair trade practices. Tariffs can also be used to protect public health or national security.

What is the difference between a tariff and a non-tariff barrier?

A tariff is a tax on imports. A non-tariff barrier is a rule or policy that restricts trade without applying a tax. For example, import quotas, licensing requirements, or product standards that limit which goods can enter a country, can be considered non-tariffs barriers.

How do tariffs affect international businesses?

Tariffs raise the cost of imported goods, squeezing profit margins for businesses that rely on international suppliers. They can also disrupt supply chains and force companies to re-evaluate sourcing strategies or pass costs onto customers.

Can currency markets help offset the impact of tariffs?

Yes – favourable exchange rate movements can help reduce the cost of imports. For example, if the pound strengthens against the yen, UK businesses importing from Japan may pay less in GBP, partially offsetting new tariffs.

However, currency markets are volatile. Business should look to use currency risk management strategies to help offset the impact of tariffs and not rely on favourable market movements.

How can businesses protect themselves from tariff-related costs?

Businesses can protect themselves by using foreign exchange (FX) solutions like forward contracts and market orders. Privalgo’s Currency Specialists help businesses build strategies to do just that.

Are tariffs still common in global trade today?

While many countries favour free trade, tariffs remain a key policy tool, especially in periods of political tension or economic uncertainty. Examples in 2025 include worldwide US tariffs under the Trump administration and ongoing sanctions impacting trade with Russia.

This article is for information purposes only and should not be regarded as financial advice.