The shipping container industry is a multi-billion-dollar industry and a vital part of the global economy. It is estimated that 80% of all goods are carried by sea.

Moving goods over vast distances, and through different transportation modes, exposes businesses to a long list of potentially damaging risks.

Finance directors play a critical role in managing these risks and ensuring the financial health of their companies.

In this article, we discuss why risk management is crucial, the impact of Covid-19 on shipping container prices and present our top four best practices for finance directors.

Understanding shipping risk management

Shipping risk management is the process of identifying, assessing, and mitigating risks associated with the shipping of goods. It is an important part of any shipping operation, as it can help to protect businesses from financial losses and other consequences.

Due to its global nature, the shipping container industry is exposed to a wide range of risks. These risks include natural disasters, political instability and financial volatility.

Shipping risk management can help to mitigate these risks and shield businesses from financial damages.

Common risks in the shipping container industry

Some of the most common risks in the shipping container industry include:

- Natural disasters: Hurricanes, floods, and earthquakes can significantly damage ships and cargo.

- Economic changes: Shifts in fuel prices, freight rates, demand and capacity can all impact business’s cashflows.

- Political instability and regulation: Wars and civil unrest can disrupt shipping lanes, piracy puts cargo at risk, and regulation and sanctions can make transporting goods difficult.

- Financial volatility: Currency fluctuations and rising interest rates can be challenging for shipping operations.

Best practices for finance directors in the shipping container industry

As mentioned above, finance directors play a crucial role in managing shipping container risk and protecting their business’s bottom line.

By instilling the following best practices, you can identify risk, assess the potential damages and act accordingly to prevent any loss.

1. Develop a shipping risk management plan

A shipping risk management plan shows how a business will identify, assess, and mitigate shipping risks. The plan should be tailored to the specific needs of your company and should be updated regularly to reflect changes in the shipping environment.

A company that ships goods internationally may want to include the following in its shipping risk management plan:

- A risk assessment that identifies the specific risks the company faces, such as natural disasters, political instability, and economic volatility.

- A mitigation strategy for each risk, such as insurance, risk transfer, risk avoidance, or risk reduction.

- A monitoring plan that outlines how the company will track and review its shipping risk management plan to ensure that it is effective.

2. Implement cargo security measures

Cargo security measures are designed to protect goods from theft, damage, and other risks during transportation. There are a variety of cargo security measures that companies can implement, such as:

- Using secure shipping containers.

- Marking containers with the company’s logo or other identifying information.

- Using tracking devices to monitor the location of containers.

- Hiring security guards to escort containers.

- Conducting background checks on employees who have access to containers.

3. Obtain the right shipping insurance policy

Shipping insurance can help to protect businesses from financial losses during unforeseen, damaging events. There are a variety of shipping insurance policies available, so it is important to choose a policy that meets the specific needs of your company.

Below are some elements to consider:

- The value of the goods being shipped.

- The route that the goods will be shipped.

- The risks associated with the shipping route.

- The company’s financial capacity to absorb a shipping loss.

4. Work with a reliable currency specialist

In addition to the risks mentioned above, finance directors in the shipping container industry also need to be aware of the risks associated with currency fluctuations.

A shipping container business may purchase containers in one currency, pay for fuel in another currency, and collect payments from customers in yet another currency.

Fluctuating currency values make it difficult for businesses in the shipping container industry to manage their costs and profits.

Partnering with a business that specialises in understanding your company’s currency requirements can be an effective way of managing the risk of currency fluctuations.

At Privalgo, every business we work with is allocated a dedication Relationship Manager. They help develop foreign exchange strategies and provide fintech solutions to mitigate currency risk.

In doing so, finance directors of shipping container business can have more confidence in managing their costs and profits.

Book a chat with a Privalgo Currency SpecialistHow the price of shipping containers has changed since the start of Covid-19

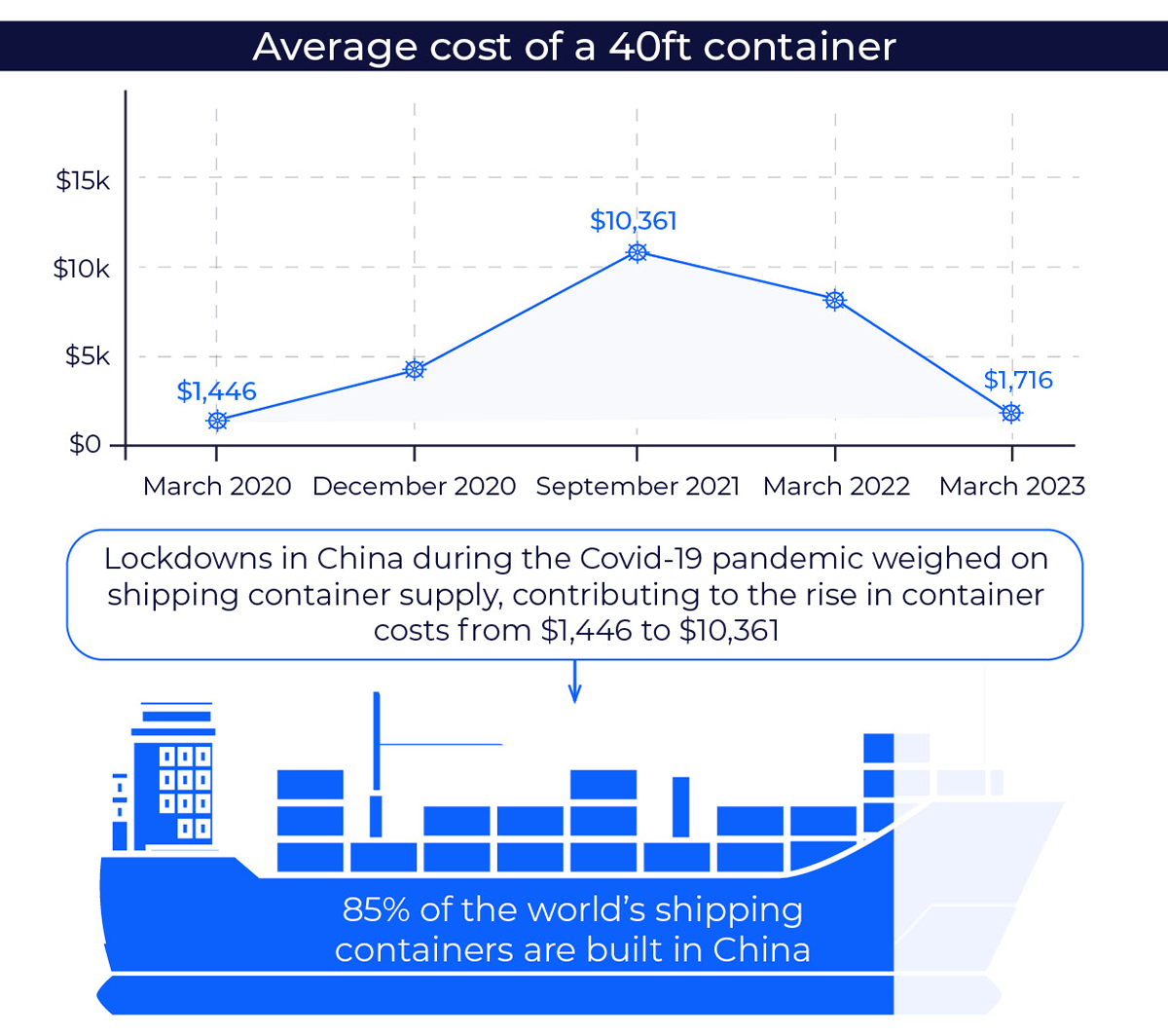

Black swan events can be a key risk factor for businesses operating in the shipping container industry. During the Covid-19 pandemic, disruption to global supply and demand for overseas good sent the price of shipping containers skyrocketing.

The average freight cost of a 40ft container in March 2020 was $1,446, just as lockdowns came into force worldwide. In September 2021, freight costs soared to peaks of $10,361.

The easing of lockdowns made demand for shipping containers rise dramatically and questions arose over whether the high prices would hinder economic recovery. This was due to several factors.

Reopening economies

As economies started to reopen, businesses and consumers began to order more goods from overseas, elevating demand for shipping containers.

The shift to online shopping

While much of the world was stuck as home, online shopping became a new habit. In February 2021, 75% of UK shoppers said they had been shopping more online than they had been before Covid-19. This boosted demand for goods from overseas.

Shipping container shortages

The pandemic also led to a shortage of shipping containers. The shortages were catalysed by multiple factors, including:

- Closed factories: Factories that make shipping containers were forced to close during the pandemic, reducing the supply of containers. 85% of the world’s shipping containers are built in China which saw long, widespread lockdowns as the country instilled its zero-Covid policy.

- Diverted containers: Containers that were already in use were diverted to other routes, which further damaging supply.

- Increased demand: The surge in demand for shipping containers outpaced the supply, which led to a sharp increase in prices.

These factors contributed to the significant increase in prices on shipping containers, impacting businesses and consumers alike.

However, prices of shipping containers have almost found their way back to pre-pandemic levels. Data from Statista shows the average price of a 40ft container for March 2023 is $1,716.

The decrease in freight rates has likely been driven by a drop in demand as high inflation prompted a cost of living crisis and improved efficiency of the shipping supply chain due to many of Covid-19’s barriers subsiding.

The pandemic was a huge shock to the system for the shipping container industry. Its impact on global trade highlighted the importance of risk management in the sector.

Summarising shipping container risk management

Risk management is an essential part of any business, but it’s especially important for businesses that operate in the shipping container industry.

The global nature of the shipping container industry exposes businesses to a wide range of risks, including natural disasters, political instability, financial volatility, and black swan events.

By following the best practices outlined in this article, finance directors can help to mitigate these risks and protect their businesses from financial losses.

If your business could benefit from expert currency management, get in touch with us by clicking the button below.

Book a chat with a Privalgo Currency Specialist