Bond yields play a vital part in determining the value of currencies. And although we hear a lot about them, it’s important to know how they work and why they influence currency movements.

But before we get stuck into bond yields and their relationship with currencies, we need to start from square one.

We’ll begin by breaking down what bonds are, what bond yields are, and the different types of bonds that are most influential in the currency market.

What are bonds?

Put simply, bonds are an ‘IOU’ between a lender and a borrower. They are issued by large entities, including governments, municipalities and multinational corporations. For most of this article, we’ll be using governments as our key example.

Governments require serious financial firepower to operate, so often need to borrow money. Bonds present the opportunity for governments to borrow money from you or I with the promise to pay back the total amount after a certain time. This total amount is known as the principal, and the day it’s repaid is called the maturity date.

So, if you bought a two-year government bond for £1,000 on 1st January 2022, you would get your £1,000 back on 1st January 2024. Your £1,000 is the principal and 1st January 2024 is the maturity date.

What are bond yields?

In addition to this, the lender will receive a rate of return on their government bond. This means you will receive interest from the government on your investment. This rate of return is known as the bond yield.

The return payments you receive differ depending on the type of bond you buy. Sometimes, your interest will be paid alongside the principal when your bond matures. Other bonds, especially those with longer durations, include interval interest payments called coupon payments.

Coupon payments are paid at certain points between the purchase date and the maturity date of your bond. Usually these occur semi-annually (once every six months). Once your bond reaches maturity, you will receive the final coupon payment as well as the principal.

The timeline below shows the repayment process of a £1,000 bond with a 2-year maturity and a 2% coupon rate paid semi-annually.

The rate on your bond means you will receive £40 on top of your £1,000 investment after two years. The 2% coupon rate is applied to each year, so 2% of £1,000 = £20 for one year. This is then paid semi-annually, resulting in a £10 payment every six months. After two years, you’ll receive your final £10 coupon payment as well as your £1,000 principal.

The relationship between bond prices and interest rates

The price of government bonds differs based on supply and demand. These types of bonds are issued off at auction to the highest bidder. If more people want to buy the bonds, the price goes up and vice versa.

Government bonds are sold with a face value and a fixed interest rate. If demand for the bonds is high, their prices may exceed the face value. However, the government will only pay back the face value for the bond. This means the amount you receive back (the bond yield) decreases. When this happens, bonds can be described as trading at a premium.

For example, let’s say demand for a particular government bond is high. You want to purchase the bond so bid for it in an auction. The bond is worth £10,000 but the high demand means you have to pay £10,090 for the bond. Once your bond reaches maturity, the government will only pay you back £10,000 + interest. As a result, the yield of your bond has decreased.

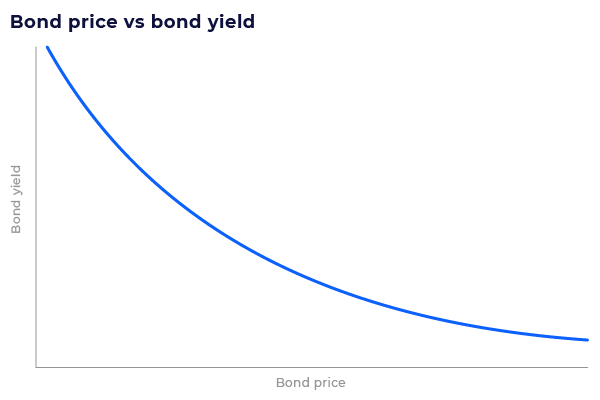

So, bond prices and bond yields have an inverse relationship. When one is high, the other is low as seen in the graph below.

Now, when demand for government bonds is low, investors are only willing to pay below face value for the bond. However, they must be paid back the full face value once it matures. Seeing as they’re getting the bond for a discount, bond yields increase.

When this happens, interest rates in the economy also rise. This is because governments must pay higher interest rates on their bonds to lure more investors into future auctions.

Interest rate hikes from central banks can cause bond yields to go up. Investors look to anticipate these hikes to capitalise on gains. When it comes to currency, traders are particularly in government bonds known as US Treasuries.

What are US Treasuries?

United States (US) Treasuries are divided into three categories based on their maturity date.

- Treasury bills (T-bills) are short-term, zero-coupon bonds. Their maturities are 4, 13, 26 or 52 weeks.

- Treasury notes (T-notes) are intermediate-term bonds and may include coupon payments. Their maturities are 2, 3, 5 or 10 years.

- Treasury bonds (T-bonds) are long-term coupon bonds. They pay their coupon rate semi-annually, offering maturities of 20 and 30 years.

The rate of interest increases in correlation with the duration of the bond. In other words, the longer you’re willing to wait before getting paid back, the better the reward for your patience.

US Treasuries are considered one of the safest investments in the world. This is because you are lending money to the United States government which has never defaulted on any debt issued, therefore never failed to repay. They are often referred to as risk-free assets.

How do US Treasuries affect the dollar?

Due to their safe haven nature, US Treasuries offer small returns in comparison to riskier assets like stocks. As such, US Treasury yields are an excellent way of gauging the sentiment of the US stock market.

When demand for Treasuries is up, it suggests investors are losing confidence in riskier assets in favour of a safer option. In this instance, the dollar usually also gets a boost as it benefits from the risk-off sentiment.

Demand for Treasuries may also increase for a different reason: when investors anticipate an interest rate rise from the Federal Reserve (Fed). Treasury yields act as an indicator of the overall direction of the US’s interest rates and expectations.

The value of currencies is heavily influenced by interest rates. Typically, investors like to put their money into countries with better rates for maximum returns. As such, currency traders pay attention to US Treasury yields as they attempt to anticipate an interest rate rise from the Fed.

One of the main ways currency traders do this is by observing the 10-year Treasury yield.

What is the 10-year Treasury yield?

The US 10-year Treasury yield is the current rate of return for US 10-year Treasury notes. Currency traders follow the fluctuating value of the 10-year yield to determine stock market sentiment and interest rate expectations.

The 10-year Treasury yield and the dollar have a direct relationship. When yields are up, the dollar is up; when yields are down, the dollar is down. This isn’t always the case but is accurate most of the time.

The chart shows the relationship between the US 10-year Treasury yield and the value of the US dollar against one of its main rivals: the Japanese yen. The green and red candlesticks show the value of the dollar against the yen and the orange line shows the value of the 10-year Treasury yield.

As you can see, there is a strong correlation between the two: when the 10-year yield rises, so does the dollar.

Currency traders attempt to determine which of these is the leader and which is the lagger. The leader moves first, with the lagger following behind. If the 10-year yield is the leader, investors will look to make decisions on their dollars based on the yield’s movements and vice versa.

The relationship is far from perfect as the 10-year Treasury is just one of a multitude of factors that affect the dollar. Currency traders also pay attention to US nonfarm payrolls, among many other things.

An example of the relationship between bond yields and currencies

Taking a look at data at the beginning of 2022, we can see the impact the US 10-year Treasury yield had on the value of the US dollar (USD).

As we approached the end of 2021, the dollar was struggling against other major currencies. Against the euro (EUR), it had dropped from 0.883 to 0.879 in the final week of December – the lowest level since 19th November.

Similarly, the Great British pound (GBP) to dollar pair had surged from 1.320 on 21st December to 1.351 on the last day of the year.

The dollar was down, but as we entered 2022, the 10-year Treasury was on the rise. January saw the yield jump from 1.52% to peaks of 1.76% in the first seven days. It’s likely the main reason behind the push was increased expectations of interest rate hikes from the Fed.

The rise buoyed the dollar, helping it to stifle the pound’s dominance and gain ground on the euro. The USD/EUR pair climbed from 0.879 to 0.884 in tandem with the rising T-note yield. They also catalysed a 0.82% jump in the US Dollar Index (DXY), leaping from 95.67 at the end of the year to 96.45 on 4th January.

Making international payments

From reading this article, you’ll know how crucial bond yields are to the currency market. Regularly checking up on government bond yields can be tiresome and confusing. And what’s more, missing vital information could cause markets to move and lose you money.

Fortunately, at Privalgo, we provide revolutionary payment solutions to protect your international transfers from such market movements. And on top of extra protection, our market-leading rates mean that your payments will maintain value throughout the exchange.

To find out more about how we can help, request a free chat with a Privalgo Currency Specialist today.