What is a payment API and how does it work?

Automated programming interfaces (APIs) are no new invention. In fact, they’ve been around almost as long as digital computers themselves. However, despite their lengthy existence, the rise of APIs has escalated dramatically in recent years.

According to research from McKinsey, 44% of companies expect to decrease costs by more than 10% through their API efforts while 31% expect revenues to increase by more than 10%.

APIs becoming a fundamental way for businesses to improve their offerings by getting their hands on different products and services to enhance the customer experience.

Payment APIs are no exception. Digital businesses need them to improve the efficiency, security, and scalability of their payment processing operations.

But what exactly are payment APIs and how do they work? To help us answer the question, we’ve enlisted the help of Karam Saggu, Product Manager at Privalgo for his expert insights.

Read on for our full breakdown or jump to a section using the contents table below.

Table of contents

- What is an API?

- How do payment APIs work for businesses?

- Benefits of using payment APIs

- How to choose the right payment API for your business

- Summarising payment APIs

- Some common FAQs we see about payment APIs

What is an API?

APIs allow two software applications to communicate with each other. They’re used by a wide range of businesses, from small startups to large enterprises.

To give you an idea of how big businesses we all know use APIs, here are some examples from Karam.

API examples

Google Maps API: The Google Maps API is used by many companies to power their maps and navigation features. For example, Google Maps is used by Uber and Lyft to provide real-time traffic updates and directions to their drivers.

X (formerly Twitter) API: The X API is used by many companies to power their social media features. For example, the X API is used by news organisations to display live tweets on their websites and by social media analytics companies to track trends and sentiment on social media.

Amazon Web Services (AWS) API: The AWS API is a suite of APIs that provide access to a wide range of cloud computing services, such as storage, computing, and networking. Many companies use the AWS API to power their websites and applications. For example, Netflix uses the AWS API to stream video to its users around the world.

Consumers might not realise the APIs used by the companies they interact with on a daily basis, but they benefit from them in a number of ways.

For example, the Google Maps API makes it easier for people to get around, the X API helps users stay informed about current events, and the AWS API helps customers access the products and services they need.

“APIs are a powerful tool that can be used to create innovative and efficient products and services. As the digital economy continues to grow, APIs are likely to play an even greater role in our lives.” – Karam Saggu.

How do payment APIs work for businesses?

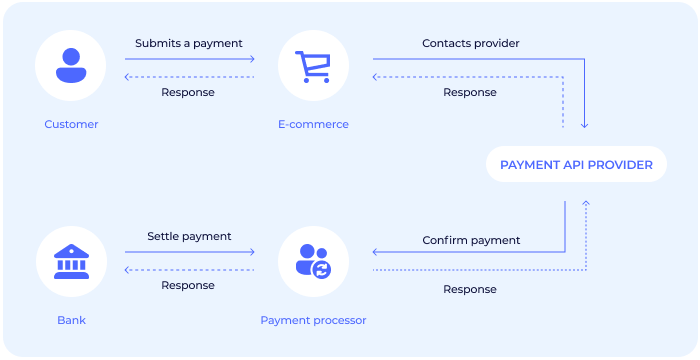

Payment APIs can be useful for your business regardless of your industry. In ecommerce, payment APIs and payment gateway APIs can be used to facilitate payments between your business and your customers.

They create a conversation between computers, connecting the customer’s form of payment (e.g., debit card, credit card, etc.) to an amount of currency and your business.

For example, you’ll probably have noticed payment options at online checkouts like debit card, credit card, PayPal, Apple Pay or buy now pay later businesses, like Klarna.

Payment APIs connect the dots between the customer, merchant and their chosen payment method as seen in the image below. APIs such as these give customers a wider variety of payment options, enhancing their experience.

They also help to streamline payment processes for corporate businesses making high-volume payments to suppliers, employees or any other beneficiary.

For instance, your business could integrate an API from a payments provider like Privalgo to make accurate, single or batch payments through your own system.

This means you can pay invoices, settle payroll, and plenty more without having to manually log into another platform.

Let’s dive into some more of the benefits of using a payment API like Privalgo’s.

Benefits of payment APIs

Payment APIs like Privalgo’s carry multiple benefits for corporate businesses making both domestic and international transactions. Some of the key benefits include:

Features in your own systems

By integrating Privalgo’s APIs into your own systems, you remove the need to use our platform to manually upload payments.

Cutting costs

Payment APIs help reduce costs by automating many of the tasks involved in payment processing, such as data entry and error-related costs. This frees up time for your staff, allowing them to focus on other tasks, such as customer service and fraud prevention.

More efficient

API integration can increase efficiency by streamlining your payment processing. This can lead to faster processing times and fewer errors.

Helping you scale

If your business makes high volumes of payments, payment APIs can drive scalability by enabling you to handle a larger volume of transactions without additional operational overheads. This is especially important if your business is experiencing rapid growth.

Strong security

API integration can enhance security by using industry-standard security protocols to protect payment data. This can help to reduce the risk of fraud and data breaches.

Total visibility

Payment APIs can provide visibility into payment statuses, providing you with real-time updates for peace of mind.

How to choose the right payment API for your business

There are many payment service providers out there offering payment APIs, so it’s worth taking some time to figure out what will work best for you. Here are some factors to consider:.

Key features

Ensure the payment API you choose carries all the key features related to your business requirements.

For example, B2C businesses in an industry like ecommerce can use payment APIs to enable faster, more secure checkout experiences for their clients.

Corporate businesses in an industry like payroll services and payment service providers can use payment APIs to send thousands of payments to employees both domestically and internationally.

Integration

Make sure the payment API you choose is easy to integrate and offers a user-friendly experience for you and/or your customers.

Payment service providers should have clear, helpful documentation to guide you through the integration process. It’s crucial these documents are also applicable to the coding language used by your systems and tech team. Providers should also offer support in case you get stuck.

At Privalgo, we pride ourselves on high-quality service and will offer your business support from a real person, not a chatbot. Your Relationship Manager will put you in direct contact with our best-in-class technology team if more detailed support is required.

Pricing model

Enlisting the services of a payment API may come with a fee. Prices are likely to vary depending on which features you require. It’s also important to keep an eye out for whether a provider’s pricing model offers a flat rate or a variable fee depending on use.

Fill in the form below to speak to us about our pricing model Privalgo’s payment API pricing model and learn more about how it can streamline your payment processing.

Summarising payment APIs

Payment APIs are used by many businesses, regardless of their industry, to streamline their payment processes for themselves and/or their customers.

They’re becoming increasingly relied upon by businesses to enhance their product offering and improve the efficiency, security, and scalability of their payment operations.

As the digital world continues to boom, we’ll undoubtably see APIs continue to develop and be integrated into even more businesses around the world.

Although Privalgo’s API is new, we ourselves have been reliant on payment and banking APIs for some time and know how beneficial they can be for businesses.

As Karam puts it, “We understand the value and opportunity of using an API vs a file or manual process, because we utilise APIs to send thousands of payments daily across our banking network.

We are extremely keen for our customers to also be able to realise this value when interacting with Privalgo. It’s something they’ve asked about for a while, so we’re really excited to offer it to them”.

Get in touch with us learn more about Privalgo’s payment API capabilities.

Contact us10 common FAQs we see about payment APIs

1. What is a payment API?

A payment API (Application Programming Interface) is a tool that allows two software applications to communicate, facilitating payment transactions between a customer’s payment method and a business’s system.

2. How do payment APIs work for B2C businesses?

Payment APIs connect the customer’s chosen payment method (e.g., debit card, PayPal) to the merchant’s account, automating and streamlining the payment process.

3. Why are payment APIs important for corporate businesses?

Payment APIs improve the efficiency, security, and scalability of payment processing, allowing businesses to automate payments, reduce costs, and offer more payment options to customers.

4. What are some examples of popular APIs used by businesses?

Examples include the Google Maps API for navigation, the X API for social media features, and the AWS API for cloud computing services.

5. How can payment APIs benefit corporate businesses?

Payment APIs can help corporate businesses by automating processes, enabling faster and more accurate payments, and providing real-time visibility into payment statuses.

6. What should I consider when choosing a payment API?

When choosing a payment API, consider key features that match your business needs, ease of integration, user-friendliness, and the provider’s support and documentation.

7. How do payment APIs help reduce costs?

Payment APIs reduce costs by automating tasks like data entry, minimising errors, and freeing up staff time for other important tasks.

8. What are the security benefits of using payment APIs?

Payment APIs enhance security by using industry-standard protocols to protect payment data, reducing the risk of fraud and data breaches.

9. Can payment APIs help my business scale?

Yes, payment APIs support scalability by allowing businesses to handle a larger volume of transactions without needing to increase staff or resources.

10. Is there a cost associated with using a payment API?

Some payment APIs come with fees, which can vary based on the features required. However, Privalgo’s payment API is currently free to use, offering seamless integration and global payment capabilities.