What are payment rails and how do they work?

Payment rails join the dots between one bank account and another. They’re the invisible tracks that move money quickly and securely all around the world.

In today’s interconnected economy, efficient and secure money transfers are crucial for businesses of all sizes. Payment rails are the infrastructure that makes these transactions possible, but what exactly are they and how do they work?

In this article, we’re exploring the concept of payment rails, how they function and why having access to multiple payment rails can give your business a significant advantage.

At Privalgo, we’re building the largest, most interconnected payments network in our space. Through this network, we can offer our clients the fastest and most cost-effective payment rails to save their businesses crucial time and money.

Jump to the section breaking down our global banking network to find out more.

Table of contents

- What are payment rails

- How do payment rails work?

- Why access to multiple payment rails matters

- The advantage of a global banking network

- Conclusion

- 10 FAQs about payment rails

What are payment rails?

Payment rails are the networks and systems that allow money to between bank accounts, both domestically and internationally.

As mentioned above, think of them as the ‘tracks’ on which financial transactions travel. These networks ensure that funds are transferred securely and efficiently between parties, whether they’re individuals, businesses, or financial institutions.

There are several types of payment rails, each serving different purposes and regions. Some of the most common include:

ACH (Automated Clearing House)

ACH is a US payment rail that processes batches of electronic payments, such as direct deposits and bill payments, offering a low-cost, reliable solution for domestic transactions.

SWIFT (Society for Worldwide Interbank Financial Telecommunication)

SWIFT is a global messaging network that enables secure financial transactions between banks across borders, commonly used for international wire transfers.

SEPA (Single Euro Payments Area)

SEPA facilitates fast, low-cost, euro-denominated payments for participating European countries, making payments smooth and streamlined across borders within the Eurozone.

CHIPS (Clearing House Interbank Payments System)

CHIPS is a US-based, real-time payment system mainly used for high-value transactions between banks, providing settlement services for domestic and international payments.

FPS (Faster Payments Service)

FPS is a UK-based payment rail that allows near-instant bank transfers between participating banks 24/7, making it an ideal choice for real-time domestic transactions.

Fedwire

Fedwire is a real-time settlement system operated by the US’s central bank – the Federal Reserve. It’s primarily used for large, time-critical payments between US financial institutions.

Interac

Interac is a Canadian payment network that allows for instant debit transactions, online payments, and peer-to-peer transfers, widely used within Canada for secure, low-cost payments.

RTP (Real-Time Payments)

As its name suggests, RTP is a US real-time payment system that enables immediate transfer of funds and confirmation of completion, providing around-the-lock access for instant domestic payments.

Card rails

Card rails are the networks operated by credit and debit card companies (such as Visa, Mastercard, and American Express) that process transactions globally. They’re convenient and can accept both online and point-of-sale payments.

Mobile payment systems

Mobile payment systems, like Apple Pay and Google Pay, allow users to make payments via smartphones by linking bank accounts or cards. They provide a fast and contactless way to make payments.

PayPal

PayPal works as an intermediary platform that helps transfer money between individuals, businesses, and financial institutions. While it operates differently from traditional banking rails like SWIFT or ACH, it still provides a way for funds to move securely across borders and between accounts.

How do payment rails work?

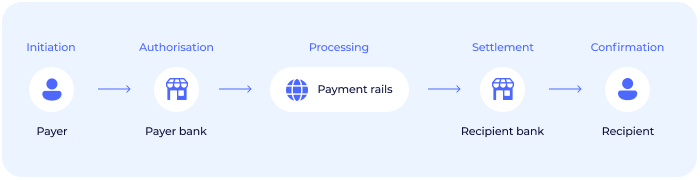

Payment rails move money from A to B following a series of steps that include multiple parties. The process works like this:

- Initiation: The payer initiates the transaction through their bank or payment provider.

- Authorisation: The payment is checked and authorised by the payer’s bank, ensuring the funds are available.

- Processing: The payment is sent through the appropriate payment rail (e.g., SWIFT, ACH) to the recipient’s bank.

- Settlement: The recipient’s bank receives the payment and credits it to the recipient’s account.

- Confirmation: Both the payer and recipient are notified of the transaction’s completion.

Each step is crucial for ensuring that payments are secure, accurate, and timely.

Why access to multiple payment rails matters

Having access to multiple payment rails is critical for businesses that operate internationally or manage high volumes of transactions. Here’s why:

Faster transactions: Some payment rails are faster than others. By having access to multiple rails, businesses can choose the quickest option, reducing delays and improving cash flow.

Lower costs: Different payment rails come with different fees. By having multiple options, businesses can choose the most cost-effective rail for each transaction, saving money in the long run.

Redundancy and reliability: If one payment rail is down or experiencing delays, having access to others ensures that transactions can still be processed smoothly. This helps minimise the risk of payment failures, saving businesses time and money.

Global access: Different payment rails serve different regions. Having access to multiple rails ensures that businesses can send and receive payments from anywhere in the world, expanding their global reach.

The advantage of a global banking network

As mentioned above, having access to multiple payment rails is essential for global businesses to survive and thrive.

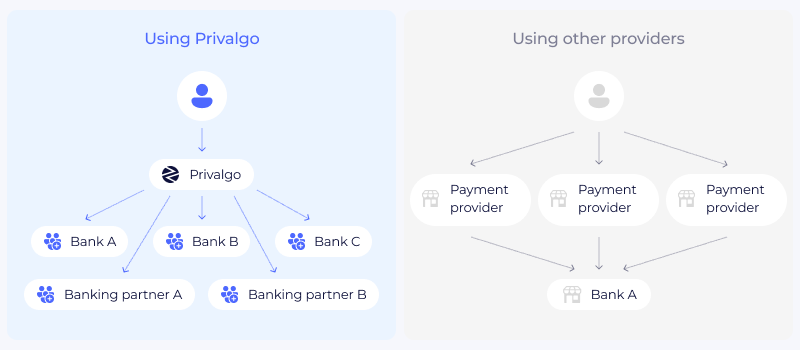

At Privalgo, we’ve built strong relationships with a global banking network of 16 banks (including Tier-1) and electronic money institutions (EMI). Your relationship with us effectively acts as a relationship with all of our leading banking counterparties.

Through this network, we can offer businesses like yours access to an extensive range of payment rails. We scan our network to identify the fastest and most cost-effective payment rail for your transactions, saving you crucial time and money whenever you send a payment.

If you’re a business currently building your payments infrastructure, contact us to learn about how our network can connect you with leading banking and payments providers all over the world.

Conclusion

Understanding what payment rails are and how they work is essential for businesses that want to optimise their financial operations internationally.

By working with Privalgo, businesses can benefit from faster, more cost-effective, and reliable payments through our global banking network. This gives you a competitive edge in managing international payments and helps your financial processes run smoothly.

Contact us today to learn more about how our access to international payment rails can drive your business’s global growth.

Read: How global payroll solutions are driving business growth

10 FAQs about payment rails

What are payment rails?

Payment rails are the networks and systems that facilitate the transfer of money between bank accounts, both domestically and internationally, ensuring that funds are transferred securely and efficiently.

How do payment rails work?

Payment rails work by routing a transaction from the payer’s bank to the recipient’s bank through a series of steps: initiation, authorisation, processing, settlement, and confirmation, ensuring secure and timely transfers.

Is PayPal a payment rail?

Yes, PayPal is considered a payment rail as it functions as an intermediary platform that enables secure money transfers between individuals, businesses, and financial institutions, both domestically and internationally.

What is the most popular payment rail?

The most popular payment rail depends on the region. Globally, SWIFT is widely used for international wire transfers. In the UK, FPS is the most popular for domestic transactions, while in the US, it’s ACH. Card rails, such as Visa and Mastercard, are also widely used for consumer payments.

What is the difference between a payment gateway and a payment rail?

A payment gateway is the technology that processes credit card payments for online and in-store transactions. A payment rail, on the other hand, is the infrastructure that moves money between bank accounts or payment networks, facilitating the actual transfer of funds.

Why is having access to multiple payment rails important for businesses?

Access to multiple payment rails gives businesses the flexibility to choose the fastest, most cost-effective, and reliable payment methods, reducing transaction costs and ensuring smooth international payments.

What is SWIFT and how does it work?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging network that facilitates secure international financial transactions between banks by sending payment instructions.

What are some examples of real-time payment rails?

Examples of real-time payment rails include FPS in the UK, RTP in the US, and Interac in Canada, all of which allow for near-instant fund transfers between bank accounts.

How do payment rails benefit international businesses?

Payment rails enable businesses to send and receive money across borders efficiently, ensuring secure, fast, and cost-effective transactions in different currencies.

How does Privalgo’s global banking network benefit businesses?

Privalgo’s global banking network includes 16 counterparties, giving businesses access to a wide range of payment rails. This helps them identify the fastest and most cost-effective routes for international payments, improving both speed and cost efficiency.