CBAM regulation: the guide for UK importersSince 2009, China has been the largest exporter of goods and services in the world with a market share of roughly 14%. In 2023, China’s exports across the globe totalled $3.38 trillion.

Its trading relationship with the UK dates back hundreds of years. Currently, China is the UK’s fifth-largest trading partner, with UK-China trade totalling £63.5 billion between Q3 2022 and Q3 2023.

For UK wholesalers like you, China provides an excellent place to secure a wide range of affordable goods. And with developments in cross-border trade, digital payments and e-commerce, it’s becoming consistently easier for UK businesses to import goods from China.

In this guide, we’ll be exploring the challenges currently facing wholesalers importing from China to the UK and how you can overcome them to ensure sustainable business growth.

How to be successful when buying in bulk from China

For your wholesale business, there are many obstacles that come with importing products across the world – and China is no exception.

Whether it’s issues with suppliers, exchange rate swings, adaptations to rules and regulations, or supply chain disruptions, the list is long – and your business needs to be prepared.

Identifying, understanding and conquering the following challenges will ensure you keep control of risk and boost your bottom line.

Controlling supply chain disruptions

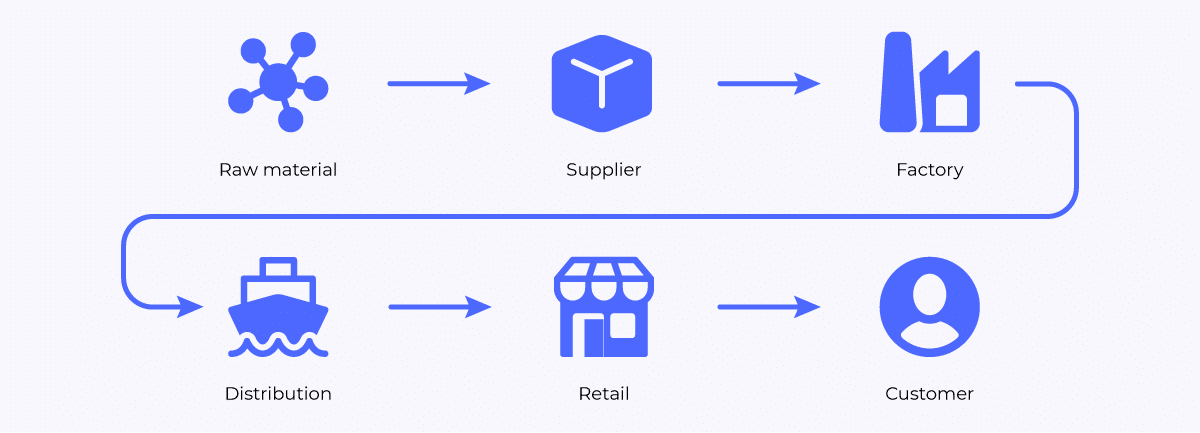

Shifting goods from A to B can be a long and risky process for when importing from China to the UK.

Many steps are required to move products from factory floor to shop shelves. And each step carries the potential for disruption, all of which can impact your bottom line.

Of all stages involved in the supply chain, a significant contributor is shipping.

Roughly 80% of global trade travels by sea, and there are only so many shipping routes available for cargo to travel.

60% of goods travelling from China to Europe and the UK pass through the Suez Canal – a narrow waterway in Egypt connecting the Red Sea with the Mediterranean Sea.

In March 2021, a container ship called Ever Given from the Taiwanese company Evergreen Marine, lost control and blocked the passage for six days.

During the blockage, more than $9 billion worth of goods ($400 million per hour) were disrupted every day.

The Suez Canal blockage, the Red Sea ship attacks in 2024, and other black swan events like the Covid-19 pandemic have the potential to cause chaos to supply chains and heavily impact importers.

But supply chain strains can appear every day, not just in extreme circumstances.

Disruptions such as port congestion, labour shortages, and weather events can be regular, unexpected and potentially damaging for your business.

Here are some ways you can limit the negative effects of supply chain disruption.

Supply chain solutions

Identifying solutions to supply chain disruptions can be challenging, especially when it feels like the disruptions are out of your control.

But there are methods you can adopt to catch supply chain ripples early and prevent significant damage.

Consider establishing a physical presence in China. Open offices, facilities or send personnel to the regions where your supply chain activities are taking place.

By creating an on-the-ground presence in China, your business can directly access local resources, information, and networks enabling better management and faster response times to challenges and opportunities within your supply chain.

It’s also essential you maintain strong relationships with stakeholders from all areas in the supply chain.

We mentioned earlier the importance of choosing the right supplier and building an effective communication plan with them.

But it’s also crucial you have fruitful relationships with manufacturers, shipping companies, and other relevant entities, too.

By striving to achieve healthy communication, collaboration, and cooperation with each party, you can improve the functioning of the supply chain and address any issues or concerns effectively.

Critical imports and supply chains strategy

In recent years, events like the Covid-19 pandemic and others mentioned earlier in this guide have put significant pressure on global supply chains.

The UK is just one of the many countries heavily affected and businesses have suffered as a result.

In January 2024, the Department for Business and Trade released the UK’s first critical imports and supply chain strategy.

It aims to support British businesses by building resilient supply chains and safeguard critical imports.

Read the full critical imports and supply chains strategy, here.

Protecting against exchange rate volatility

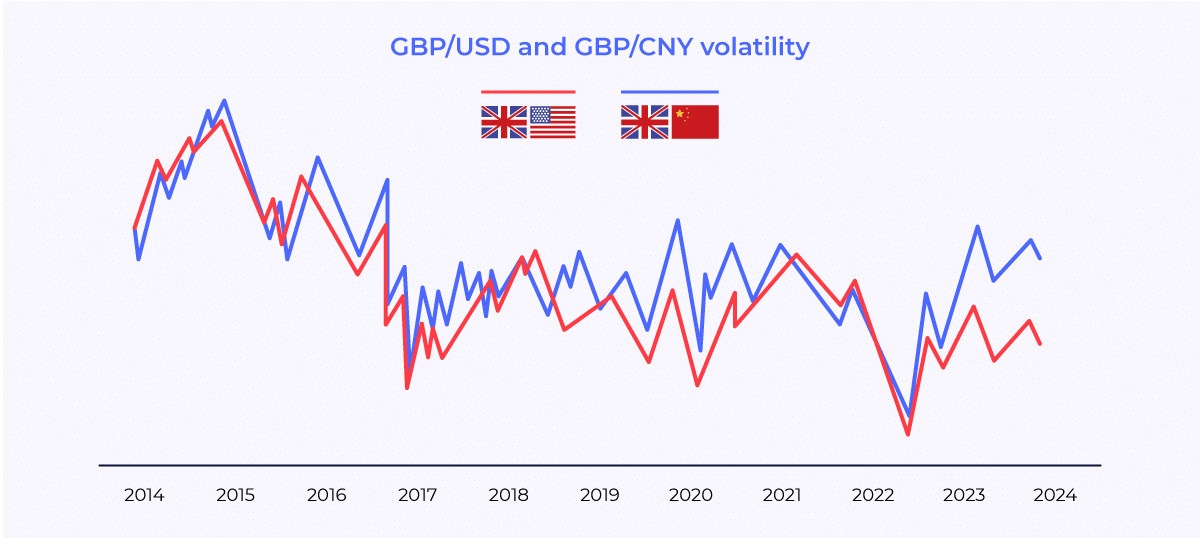

A crucial factor affecting your business when importing goods from China to the UK is foreign exchange (FX) risk.

The domestic currency in the UK is the pound sterling (GBP) while in China it’s the renminbi (CNY) – also known as the yuan.

Importantly, while CNY is China’s domestic currency, most Chinese businesses engaged in global trade accept payments in United States dollars (USD).

Therefore, the exchange rate between GBP, USD and CNY plays a significant role in the process of purchasing goods from China.

When the exchange rate between GBP and USD or CNY is high, your business will pay less for goods purchased from Chinese suppliers. When it’s low, you’ll pay more.

As currency values are changing every second, this presents a serious issue for your business in terms of budgeting and purchasing power.

But there are ways to manage FX risk and limit the impact of currency value movements from affecting profits.

The best way to do this is to work with an FX and international payments provider. It’s essential this provider can facilitate fast, accurate payments from GBP to both USD and CNY.

The following case study shows how a UK wholesaler was able to save £60,000 by managing FX risk effectively.

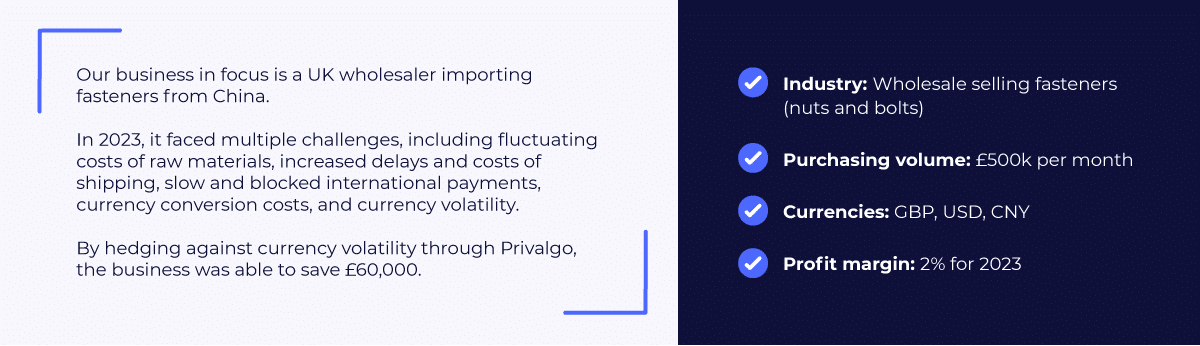

Case study: UK wholesaler importing fasteners from China saves £60,000

Our business in focus is a UK wholesaler that imports fasteners (nuts and bolts) from China. The business purchases £500k worth of goods from China every month.

The wholesaler mainly makes payments to its Chinese suppliers in USD. However, in some instances, it pays in CNY.

The wholesaler had set profit margins at 2% for the year 2023. In order to reach its target, the business had to overcome multiple obstacles.

Fluctuating costs of raw materials

Metal is an essential component used to make the business’s imported products. When the cost of metal rises, the Chinese manufacturer they use is charged more.

This fee is then passed on to the UK wholesaler, directly impacting their bottom line.

Shipping routes: delays and costs

The business is constantly under pressure from rising shipping costs and the availability of ships and containers.

It was affected by the Suez Canal blockage in 2021 and the strain on supply from Covid-19.

As a result, the business has to budget for potential delays and unexpected costs caused by shipping.

Slow and blocked payments

The UK wholesaler previously used a traditional high street bank to make payments to China. However, the Chinese banks the business sent money to often blocked or slowed down its payments.

As well as slow payments, the lack of visibility for the business was damaging to its financial strategy and cash flow.

The bank they used had no transparency into the position of the business’s payments, meaning it didn’t know or communicate whether a payment had been blocked or delayed.

To speed up their processes and save money, the business switched from using its UK-based traditional bank to Privalgo, and we become their international payments provider.

Our transaction monitoring was significantly more advanced and allowed the business to track exactly where their payments were. This meant they could manage their finances and cash flow with increased ease and confidence.

Currency conversion costs

As mentioned earlier, our example UK wholesaler pays its Chinese suppliers in both USD and CNY, with the majority of payments being in USD.

However, some suppliers accept payments in CNY to avoid having to convert USD transactions to its domestic currency themselves.

By paying in CNY, the price per unit (PPU) charged by specific Chinese suppliers marginally decreases. This meant the business could save on the cost of its products from certain suppliers by paying them in CNY.

Previously, the UK wholesaler’s bank was unable to facilitate CNY payments, only USD. Through Privalgo, the business was able to pay its suppliers in both currencies and capitalise on cost-saving opportunities through our CNY payment capabilities.

Currency volatility

At the start of the year, the UK wholesaler set a price its customers would pay for its imported products.

However, due to the constant swings in the value of GBP against USD and CNY, the business lacked certainty over its costs.

Fortunately, the UK wholesaler was able to protect its bottom line against such volatility by using foreign exchange hedging strategies through Privalgo.

Our currency specialists helped the business implement a hedging strategy comprising FX products like market orders and forward contracts.

Market orders automatically triggered a transaction from GBP to either USD or CNY when the market was in the business’s favour. This helped them capitalise on positive market swings.

Forward contracts locked in a rate of exchange for the business. This meant the business knew exactly how much it was going to pay for its USD and CNY when making transactions in GBP.

By effectively managing currency volatility with this hedging strategy through Privalgo, the business was able to increase its profit margin by 50% to 3%.

This saved the UK wholesaler £60,000 over the course of the year.

Issues with Chinese wholesale suppliers

Making sure the products you import from China arrive on time and in the best possible condition is never straightforward.

To make life easier, take your time choosing the right Chinese supplier. Trade associations like the China Chamber of Commerce for Importers and Exporters (CCCIEC) and online marketplaces like Alibaba are good places to start.

Forming a relationship with a supplier that communicates well will be a huge help if problems arise in future.

In their article, Eight things you need to know about doing business in China, author Sam Pileggi explains, “The Chinese believe in fostering meaningful long-term relationships and you’ll need to understand that the concepts of ‘Mianzii – i.e. the idea of saving face – and ‘Guanxi’ – which roughly translates as “relationships” or “connections” – are a crucial part of business life in China.”

It’s also important that the supplier has processes in place to handle quality control issues and delays.

Below are some of the difficulties you might face when dealing with suppliers in China and how you can master them.

How to communicate with Chinese suppliers

Language, cultural differences, time zones, and different negotiation methods can create significant challenges when importing from China to the UK.

You don’t have to become fluent in Chinese or hire a translator (although both methods are perfectly viable if you have the time and/or budget) to communicate with suppliers effectively.

Instead, you can follow the steps below.

Understand the culture and keep your language simple

Mandarin in the most commonly spoken language, but Cantonese and Hokkien are also widely spoken in China. While it’s valuable to understand some key words and phrases, it’s also important to understand how to approach the cultural differences in communication.

In China, indirect communication is common. So, when visiting a Chinese supplier or manufacturer, you should consider using communications methods like visual aids (graphs, diagrams or samples), demonstrations and non-verbal cues.

Many Chinese manufacturers will have staff that can speak basic English. It’s therefore important you keep your language simple.

Use short sentences, avoid jargon, and keep your communication straightforward. Make sure your message stays focused, clearly outlining your needs.

Consider structure, too. Bullet points and numbering can be useful when breaking down complex requests.

Build a communication process

Creating a familiar communication pattern will help Chinese suppliers understand your requests. Draw up templates and use the same formatting for emails and other communication.

This will make it clear to the supplier what you’re discussing and what to expect.

Be clear on your process for checking on progress. Decide on your method of regular communication and how often you’ll check in.

Also, assign specific people to certain responsibilities so both the people on your end and the supplier’s will be familiar with who they’re talking to.

Handling time zones

China is eight hours ahead of the UK. This means it’s crucial you plan your communication accordingly.

Coordinate your discussions with Chinese suppliers during overlapping working hours for effective communication.

Ask your supplier if using an app like WeChat (China’s version of WhatsApp) would make communication easier and faster than using email.

Managing delays with Chinese suppliers

Unfortunately, delays often come as part of the package when importing goods manufactured in China to the UK.

Production times vary and getting clear information about progress can be difficult.

Generally, good practice is to be prepared for delays; there’s often little you can do when production faces setbacks on the other side of the world.

Deciding how much time to allow for delays isn’t straightforward. Typically, leaving around one month for new orders and two weeks for repeated orders is considered sensible leeway for production delays.

But manufacturing accounts for only a portion of the import process.

The availability of ships and shipping containers is still in short supply following the Covid-19 pandemic.

As a result, estimating journey times can be tricky. Shipping products from China to the UK usually takes around 30-40 days (3-4 weeks port to port or 6-8 weeks door to door).

You should allow a substantial amount of time for both production delays and shipping when importing products from China to the UK.

Read: Shipping container industry: Top 4 risk management practices.

Quality control

Maintaining the quality of goods when importing from China to the UK can be a challenge. There are multiple areas where this may create a problem for wholesale businesses like yours.

- Poor quality products

- Inconsistent quality of products

- No quality improvement

It may be that only one or a handful of products fail to meet standards. In this case, the issue is inconvenient but not a disaster.

However, it’s not unheard of for whole batches of products to miss the mark. It’s therefore essential you identify a Chinese manufacturer who meets your standards.

Often, quality issues arise when using new or unfamiliar suppliers.

Similarly to what we discussed earlier, researching the reputation of the supplier and/or manufacturer your business plans to use is important. Check they have experience handling products in your industry.

If possible, visit the manufacturer during production and test the products yourself.

Managing ever-changing rules and regulations

Changes to trading rules and regulations can cause operational nightmares when importing from China to the UK.

The UK and China have their own regulatory and legal frameworks. And as Josh Morrison points out in their article, Entering the Dragon’s Den: Top Tips for U.K. Businesses Venturing into China’s Lucrative Market, your business should “engage with legal experts who specialise in China’s business laws to ensure compliance and mitigate potential risks.”

“Familiarise yourself with regulations concerning intellectual property protection, licensing, product certifications, and data privacy, as they play a crucial role in safeguarding your business interests.”

Whether they bring additional costs or create logistical headaches, changes to the legal side of things can weigh on your business.

Failing to comply with trading rules and regulations can have serious consequences.

To make sure you stay on top, we’ve picked out some important rules and regulations to keep an eye on in 2024 and beyond.

Carbon Border Adjustment Mechanism (CBAM) UK

In 2027, the UK government will introduce a Carbon Border Adjustment Mechanism (CBAM) for businesses importing goods from overseas.

This means you may face charges depending on the greenhouse gas emissions used to make your imported products.

Essentially, you’ll be paying a price for carbon.

Certain goods imported to the UK will be targeted by the UK CBAM. These include aluminium, cement, ceramics, fertiliser, glass, hydrogen, iron and steel sectors.

Despite there being some time until the UK CBAM comes into effect, you should start preparing for its introduction sooner rather than later.

Read: CBAM regulation: the guide for UK importers.

Import tax from China to UK

Importing from China to the UK means you’ll have to pay tax on your imports. The rate at which your business will be charged depends on the value of the goods you’re importing.

It’s essential you stay up to date on the current import tax from China to the UK. If you’re found to be paying too little, you may be required to repay what you owe, be hit with a fine and potentially face legal action.

UK customs currently charges nothing for goods worth less than £135, 2.5% for ‘gifts’ valued between £135 and £630, and a higher charge for any shipment valued at more than £630.

The import tax you’ll pay depends on the type of product you’re purchasing and the country you’re importing from (China).

To find out how much you need to pay, follow the steps in the UK government website.

Read: What are tariffs and restrictions in global trade?

Documentation changes

Many UK importers will know the hassle that comes with paper documentation. And when it comes to shipping documents, the endless cycle of paperwork can be tough to keep control of.

Misplaced documents can lead to delays with customs and potential charges caused by held up shipments.

But this is all about to change.

Regarding developments in export documentation, Paul Lee, Business Development Manager at ATA Carnet Express explains, “The chamber of commerce have recently introduced plain paper certificates of origin so they can be printed anywhere in the world when required.”

“The UK government are aiming to introduce a single window platform by 2025 for all shipping documents to go completely paperless ready for digitalisation of the process.”

“This can only be a good thing as no more lost documents, no demurrage charges with goods waiting to be cleared by customs due to missing documents.”

UK wholesalers can expect to make the move to digitalised documentation in 2025 and ease the pressure of clunky paperwork.

Key takeaways for sustainable business growth

For wholesalers importing from China to the UK, vigilance, adaptability and strategic planning are essential for sustainable business growth.

In this guide we’ve outlined the steps required to overcome the challenges that could prevent you from achieving such progress.

Barriers like supplier reliability, communication barriers, currency fluctuations, regulatory changes, and supply chain disruption, can all cause headaches – and measures need to be taken to overcome them.

To do so, your business could consider:

Our case study highlighted the benefits of using our FX hedging strategies and innovative payment solutions to enhance financial stability and maximise profits.

Looking ahead, proactive engagement with evolving regulations, such as the Carbon Border Adjustment Mechanism (CBAM) and import tax considerations, will be essential for maintaining compliance and managing your costs effectively.

By staying informed, proactive, and adaptable, UK wholesale businesses like yours can import from China with confidence, ensuring long-term profitability in the years to come.

To discuss how our FX risk management and intelligent payment solutions can add value to your business, book an introductory call with one of our Currency Specialists by filling out the form below.