FX volatility: Why do exchange rates change?

Exchange rates are the beating heart of the foreign exchange (FX) market. They are constantly moving, and sudden changes can have dramatic effects on economies, businesses and financial markets.

In this article, we’re analysing what makes exchange rates rise and fall, and why managing FX volatility is crucial for global businesses.

Firstly, let’s look at how currency values work.

Currencies are traded on a floating rate exchange system in the FX market. Their values appreciate (go up) and depreciate (go down) based on supply and demand.

Unlike stocks, the market price of currencies isn’t based on intrinsic value. Instead, currencies are traded in pairs and the exchange rate between two currencies represents their value.

Currency pairs explained

Currency pairs are written as fractions. On one side of the fraction, we have a base currency. On the other, we have a counter currency.

The base currency resembles one unit of a currency (one pound, for example). The counter currency then shows how many units of another currency are needed to match one unit of the base currency. Let’s look at a current example.

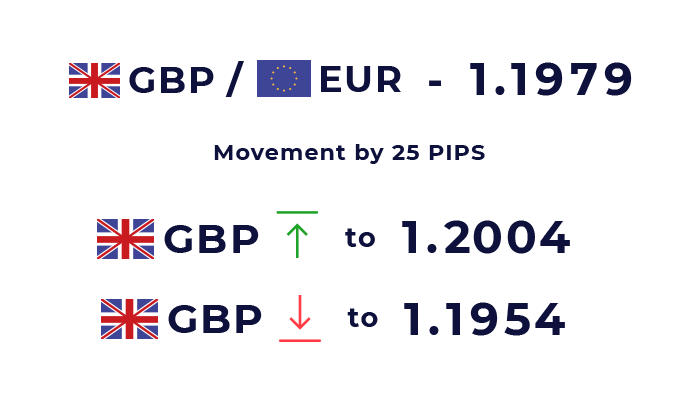

At the time of writing, the pound-euro or GBP/EUR currency pair is trading at 1/1.1979 (this is typically shortened to 1.1979).

In this example, the pound is the base currency, and the euro is the counter currency. Thus, one pound is equal to 1.1979 euros.

Currency appreciation means the base currency has become more valuable against the counter currency.

Let’s say GBP/EUR has shifted to 1.2004, increasing by 25 pips (percentage in points). You can now buy 1.2004 euros with one pound. Therefore, the pound has appreciated against the euro.

Currency depreciation is the reverse effect. If GBP/EUR drops by 25 pips to 1.1954, one pound is now equal to fewer euros that it was before. It has depreciated against the euro.

Read: How do pips and pipettes work in foreign exchange?

The above image shows the value of the pound if it were to appreciate by 25 pips against the euro. Starting from an exchange rate of 1.1979, the pound’s value appreciates to 1.2004. It also shows the value of the pound if it were to depreciate against the euro. A 25 pip depreciation sees GBP/EUR drop from 1.1979 to 1.1954.

What causes exchange rates to rise?

A currency’s value increases when it experiences a positive shift in supply and demand. There are plenty of ways a currency can get a boost. Here are a few of them using the UK and pound sterling as an example:

Hot money flows

When a nation’s central bank increases interest rates, investors get a better return on their savings in that country.

So, if the Bank of England was to hike interest rates, saving money in UK banks, buying UK bonds, and other British investments become more appealing. Investors who chase the best rates may pour their money into the UK. They can capitalise on the new, higher bank rates.

When large amounts of money surge into UK banks from abroad, this is known as hot money flows. The urge to save in UK banks means an increase in demand for sterling.

Read: How do interest rates affect the pound?

Overseas investment in UK businesses

If a British business receives investment from abroad, the value of sterling could go up. This could be from a major investment, such as building a new factory to produce goods in the UK.

It could also be a significant takeover bid for a British business or institution – the sale of Royal Mail to Czech investors, for example.

Foreign investment puts money into the UK, lifting the pound’s value.

Read: What are restricted and exotic currencies

Purchase of UK goods and services

When people from abroad buy British goods and services, there is an increase in demand for sterling.

Let’s assume there’s a surge in Europeans wanting to buy UK-made cars. The British manufacturers may only accept their payments in pounds. So, the buyers must exchange their euros for pounds to buy a car. Demand for sterling increases.

Alternatively, there might be an influx of Chinese tourists visiting the UK. Staying in hotels, eating in restaurants and purchasing souvenirs requires the British currency. The Chinese tourists will need to change yuan into sterling, thus pushing demand for the pound.

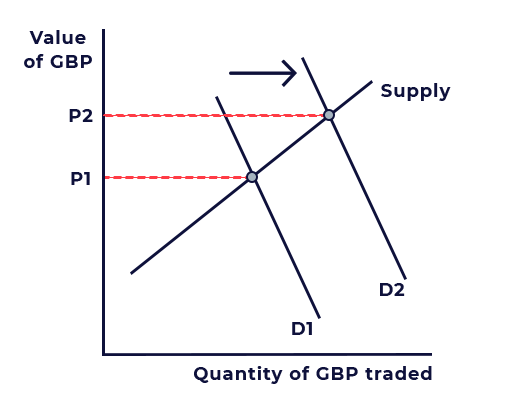

We can apply these examples to the supply and demand graph below. The graph shows how an outward shift in demand for the pound increases its value.

Assuming all other things remain the same, the purchase of British goods and services from people abroad lifts sterling’s demand from D1 to D2 on the graph. The result is an increase in value of GBP, shifting from P1 to P2 on the graph.

Read: What is a pegged exchange rate and why do countries do it?

What causes exchange rates to fall?

A negative movement in supply and demand causes a currency’s value to drop. There are various factors that can influence this. Let’s look at some examples:

Political instability

An uncertain or unstable political landscape can have detrimental effects on a currency’s demand.

In early 2025, Donald Trump took office in the United States and introduced tariffs on multiple countries around the world. With question marks over the impact of these tariffs on the global political landscape, the US Dollar Index dropped by 4% from 28 February to 18 March.

In 2016, the UK voted to leave the European Union. Though not impossible, the decision was unexpected, and the resulting uncertainty drove investors away from British assets.

Demand for the pound dropped significantly in the 24 hours following the vote. Sterling depreciated by more than 8% against the euro and almost 12% against the dollar.

Risk aversion

Investors tangle with risk constantly. Often, they want to keep their money in safe places. If investors withdraw their money from a country deemed unsafe, its exchange rate may fall.

Typically, when uncertainty is high, riskier assets like stocks suffer and safer assets like government bonds thrive. Also, the foreign exchange market considers some currencies to be safer than others. These are commonly referred to as risk-off or safe haven currencies.

In times of uncertainty, like black swan events, investors flee to currencies that are considered safe. During the financial crisis in 2008, risk-on currencies fell significantly. The pound (risk-on) suffered greatly against the dollar (risk-off) and Japanese yen (risk-off).

Read: What are black swan events and how do they affect foreign exchange?

Interest rate reduction

We talked earlier about how interest rate hikes contribute to currency appreciation. The reverse effect happens when a central bank decreases interest rates.

If the Federal Reserve (the US central bank) reduces the bank rate, the dollar becomes less desirable. Therefore, investors get a better return elsewhere, resulting in an outflow of hot money from the US.

Traders then sell the dollar in currency markets, leading to an increase in supply. The low demand for the dollar, and high supply, means its value depreciates.

Read: How do interest rates affect the dollar

Effects of currency movement

Exchange rate changes directly impact the value of a nation’s imports and exports. These can have both positive and negative effects on the economy. Let’s break them down.

Effects of a strong currency on imports and exports

For this example, we’ll use the dollar (USD) and the euro (EUR). If the dollar appreciates against the euro, the US experiences a rise in external purchasing power. One dollar goes further, so goods imported from EU countries become cheaper.

As a result, demand for EU goods to the US increases. More affordable goods means lower prices, therefore contributing to lower inflation.

However, an appreciating USD/EUR means US goods become more expensive in Europe. Demand for US goods drops, resulting in fewer exports. A reduction in the value of exports compared to imports means the US has a trade deficit. This may lead to a slowdown in economic growth.

Effects of a weak currency on imports and exports

If the dollar depreciates against the euro, imports become more expensive and exports become cheaper. Now, American goods seem very attractive to European buyers. Export sales expand and import sales contract.

This has multiple economic effects:

- US domestic production increases to match the rising foreign demand.

- The trade deficit decreases as the value of exports now exceeds the value of imports.

- Employment rises as more jobs are created to equal overseas demand.

- Cost-push inflation occurs as the US now spends more on goods such as raw materials from the EU.

These effects lead to an increase in US aggregate demand. All things being the same, currency depreciation can be beneficial for GDP growth. It can help governments achieve their macroeconomic objectives.

During his presidential election campaign – and into his presidency in 2025 – Donald Trump spoke about his desire to weaken the dollar.

The president suggested that a weaker dollar could lift the competitivity of US exports and help regain control of the US trade deficit, highlighting some of the benefits of a weaker currency.

Read: What are tariffs and restrictions on global trade?

Why managing exchange rate volatility matters

We mentioned earlier that currency values are constantly moving. While this poses challenges for policymakers and economists, it makes life tricky for businesses too.

Volatility is a term synonymous with foreign exchange. There are a multitude of factors that contribute to currency appreciation and depreciation. And often these are out of our control.

Read: How does inflation affect exchange rates?

Example of how exchange rates affect businesses

For businesses, exchange rate volatility can be crucial to profitability. Let’s imagine a German car manufacturer has settled on a deal to purchase essential parts from a supplier in the UK. The price has been agreed, but the actual transaction won’t be processed for another six months.

Within the six-month period, the euro weakens against the pound. This means one euro is now worth less than it was when the two businesses shook hands on a deal.

If we look at the real-world movements of GBP/EUR, we’ll see the pair climbed from 1.1881 on 1 September 2024 to 1.2107 on 1 March 2025.

Let’s say the German car manufacturer agreed to purchase £1,000,000 worth of parts from the UK supplier in June 2024. At this point, the German business had to pay €1,188,100 for its parts.

However, the pound’s appreciation against the euro means that the German car manufacturer has to pay €1,210,700 – a €22,600 difference – for its parts.

This example shows how businesses can suffer at the hands of exchange rate volatility. But it can work in their favour, too.

If the euro had appreciated at the same rate against the pound, the German car manufacturer would have benefitted from the currency movement, saving them money.

If your business makes international payments in foreign currencies, it’s essential you manage FX volatility to limit examples like this from damaging your bottom line.

At Privalgo, we can help your businesses lock in favourable rates of exchange for transaction at a later date. So, if you agree a price with another business today, you can secure today’s exchange rate and pay later.

This way, you can budget with more confidence, and protect your profits from negative FX movements.

Get it touch with one of our Currency Specialists today to learn how we can help your business scale further, faster.

Conclusion

Currency values are in constant motion, driven by economic forces, political events, and shifting investor sentiment. For businesses operating across borders, this often-unpredictable movement can present both opportunity and risk.

Understanding what makes exchange rates rise and fall is more than a macroeconomic curiosity; it’s a vital part of protecting your bottom line. As we’ve seen, a small shift in the currency market can add tens of thousands to your costs, depending on how prepared you are.

That’s why managing exchange rate volatility is essential. At Privalgo, our Currency Specialists help businesses take control of their international payments with FX solutions, transparent pricing, and proactive risk management.

Whether you’re trading with overseas suppliers, expanding into new markets, or simply looking to protect your profit margins, we’re here to support your growth in an unpredictable landscape.

Get in touch today to learn how we can help you scale further, faster.

10 FAQs about exchange rate volatility

Below are 10 frequently asked questions about exchange rate volatility and the factors that make currency values rise and fall.

What does it mean when a currency is volatile?

Currency volatility refers to how frequently and how much a currency’s value fluctuates in the foreign exchange market. A highly volatile currency experiences large, unpredictable swings, often in response to political events, economic data, or market sentiment.

Why is currency volatility bad?

Volatility can make it difficult for businesses to plan and budget. A sudden drop in a currency’s value can increase the cost of overseas payments, erode profit margins, and disrupt cash flow – especially if prices were agreed in advance.

How does exchange rate volatility affect businesses?

If your business pays or receives money in foreign currencies, fluctuating exchange rates can increase or decrease the actual amount received or paid. This unpredictability can lead to financial losses or gains and make forecasting more challenging.

What does a weak pound mean for exchange rates?

A weak pound means you get less foreign currency for every pound exchanged. For UK businesses importing goods, this increases costs. However, it can benefit exporters by making UK goods cheaper for overseas buyers.

What causes exchange rates to change?

Exchange rates move due to supply and demand. Factors include interest rate changes, inflation, political stability, economic performance, trade balances, and investor sentiment.

Can exchange rate volatility be predicted?

While trends and forecasts can provide guidance, currency markets are influenced by many variables, including unexpected events, making it difficult to predict movements with certainty.

How can I protect my business from FX volatility?

Using solutions like forward contracts or market orders can help lock in rates or target favourable levels. At Privalgo, our Currency Specialists can help you learn more about how these solutions can protect your bottom line from currency volatility.

How do interest rates affect exchange rates?

Higher interest rates tend to strengthen a currency by attracting foreign investment. Conversely, rate cuts often weaken a currency as returns on savings and investments become less attractive.

Which currencies are considered the most volatile?

Emerging market currencies like the Turkish lira or South African rand are typically more volatile than major currencies like the US dollar, euro or pound. Volatility is often higher in currencies tied to uncertain political or economic environments.

What’s the benefit of a strong currency for businesses?

A strong currency increases buying power when importing goods, reducing costs. However, it can also make exports more expensive for foreign buyers, which may reduce international demand.