How do interest rates affect the pound?

Interest rates and exchange rates typically have a direct relationship. Put simply, when one goes up, so does the other.

The main driver of movement in this relationship is interest rates. When interest rates fall, exchange rates fall, and vice versa. If exchange rates go up or down, they may affect central banks’ decisions on interest rates. But more on that later.

While this works as a general rule, it’s not always so straightforward.

In this article, we’ll be exploring what interest rates are, how changes to interest rates have affected the pound in the past and what this could mean for autumn 2024 and beyond.

Read on or jump to a section below.

Table of contents

- What are interest rates?

- Why do interest changes affect the pound?

- How have interest rate changes affected the pound in the past?

- How have interest rates affected the pound so far in 2024?

- How could interest rate cuts affect the pound in 2024 and beyond?

- Conclusion

- 10 FAQs about how interest rates affect the pound

What are interest rates?

Interest rates are a tool used by central banks to control inflation (the rate at which prices are rising in a country). In the UK, the central bank is the Bank of England (BoE).

The BoE will set a target rate of inflation for each year and will raise or lower interest rates to maintain this value; in 2024, the target was 2%.

When interest rates rise, it becomes more expensive for people and businesses to borrow money. It also means they can increase their savings on money kept in a bank.

As a result, spending on goods and services decreases, so prices drop. Once inflation is at target, central banks can consider reducing interest rates to encourage more public spending to spark economic growth.

Read: Why is inflation rising in the UK?

Why do interest rate changes affect the pound?

Generally, when the Bank of England raises interest rates, the pound rises in value. This is because it attracts foreign investment.

Overseas investors gain higher returns on interest-bearing assets, such as government bonds or deposits. This increased demand for UK assets increases the value of the pound. So, if the UK’s interest rates are high, demand for the pound will increase along with its exchange rate.

When the BoE cuts interest rates, the pound falls as overseas investors seek out higher returns elsewhere.

However, the pound’s exchange rate is vulnerable to multiple external factors that can prevent interest rate changes from affecting its value. Here are some other factors that can affect the value of the pound:

Market expectations

The Bank of England votes on whether to increase, hold or decrease interest rates eight times per year. Ahead of an interest rate by the BoE’s monetary policy committee (MPC), the pound may rise or fall as currency investors predict the outcome of the vote.

If markets expect the BoE to cut interest rates, the pound may fall days or weeks before the decision. So, when the vote is announced, the pound may experience little movement. This is known as markets ‘pricing in’ an interest rate decision.

However, if the MPC’s vote is different to what markets have priced in, it can cause significant movement to the pound.

This is why many businesses relying on the pound use foreign exchange (FX) risk solutions to protect their costs boost their profits.

At Privalgo, we use advanced FX products such as forward contracts to protect your business’s international payments from currency volatility and market orders to help you capitalise on favourable opportunities in the market.

Fill out the form below and let’s discuss how our solutions can drive growth for your business.

The health of the UK economy

Despite interest rates having a noticeable effect on the pound, investors also consider the health of the UK economy before making sterling purchases.

Raising interest rates typically stunts economic growth as borrowing costs increase causing a drop in spending and economic activity.

If investors see higher rates as a threat to economic growth or a potential cause of recession in the UK, the decision to hold or raise interest rates may have no effect or even weaken the pound.

Conversely, if the UK economy is strong, a cut to interest rates may have little impact on the pound.

The global financial environment

Similarly to the health of the UK economy, the pound is also susceptible to the state of the global economy.

When investors are fearful of financial or geopolitical uncertainty, they flock to safe commodities such as the US dollar or gold. This is known as a risk-off market sentiment.

As the pound is considered a riskier asset than the dollar, it often drops in value when markets move to a risk-off mentality, regardless of the UK’s current interest rate position.

How have interest rate changes affected the pound in the past?

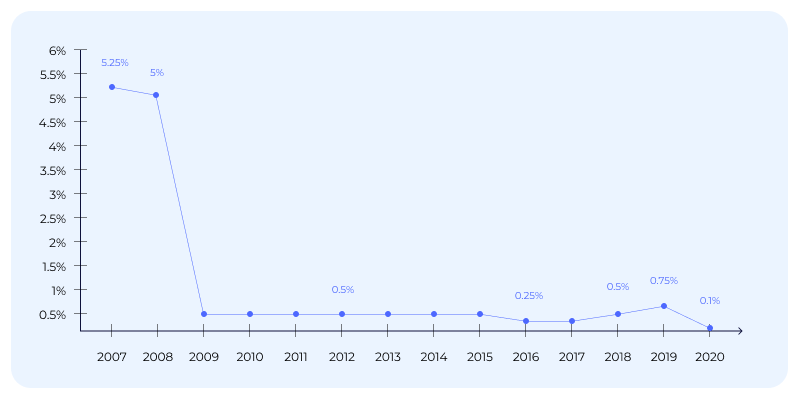

Interest rates in the UK have changed significantly throughout the years. They average 7.08% from 1971 to 2024, reaching peaks of 17% and pits of 0.1% along the way.

In many cases, the Bank of England has been forced to act due to significant black swan events impacting the UK’s economy. Let’s dive into some examples.

The financial crisis (2008)

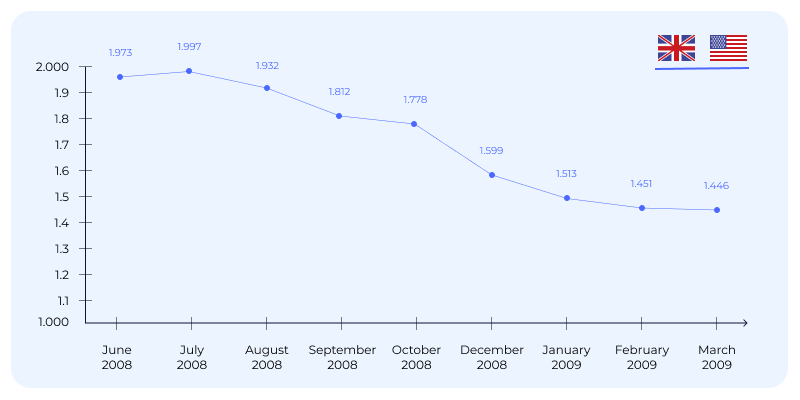

One of the most significant periods of rate cuts came during the 2008 financial crisis. In response to the global economic meltdown, the BoE aggressively slashed interest rates from 5% in October 2008 to 0.5% in March 2009 as shown in the graph below.

As a result, the pound dropped significantly against major currencies, particularly the US dollar and euro. This was largely due to a risk-off market mentality, leading investors to pull out of the UK and seek safer assets elsewhere.

Impact on the pound

Against the dollar (GBP/USD), the pound dropped sharply, losing over 25% of its value from mid-2008 to early 2009.

What did this mean for businesses?

The sharp drop in the pound’s value impact UK businesses in different ways.

The pound’s plunge was especially harmful on importers reliant on foreign goods and materials. This is because they lost purchasing power against other currencies, meaning their costs increased significantly.

For example, in August 2008, £10,000 could buy your business $19,800 worth of goods. By March 2009, the same £10,000 would only get you $14,300 worth of goods.

On the other hand, many UK exporters benefitted from the pound’s plunge as it became cheaper for overseas buyers to purchase their goods and services.

The tight credit environment created by the 2008 financial crisis also meant that borrowing became more difficult, limiting business investment and expansion.

The Brexit referendum (2016)

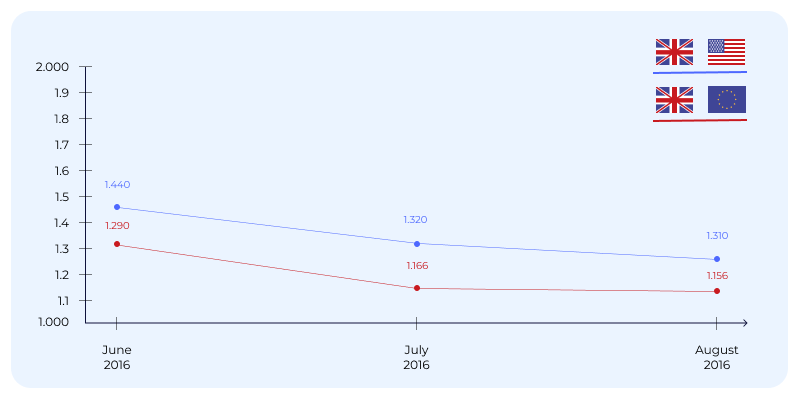

Following the UK’s decision to leave the European Union in June 2016, the Bank of England took precautionary measures to stabilise the economy. This included a rate cut from 0.5% to 0.25% in August 2016. Although the rate cut appeared small, the uncertainty surrounding Brexit had already weakened the pound significantly, and the rate cut only piled on more pressure.

Impact on the pound

GBP/USD fell from 1.44 just before the referendum to around 1.31 after the rate cut. The pound also weakened against the euro, reflecting investors’ concerns about the UK’s economic outlook.

What did this mean for businesses?

The combination of Brexit uncertainty and the BoE’s rate cut in August 2016 had similar, significant impacts on businesses to those mentioned above.

The pound’s drop in value meant costs increased for import-reliant businesses, squeezing their profit margins.

For UK exporters, the weaker pound meant their goods and services became cheaper for overseas buyers. This provided a temporary boost for some export-oriented businesses, especially those dealing with markets outside the EU.

However, other factors also weighed on UK businesses following Brexit. Many businesses delayed investment decisions, expansion plans, and hiring due to uncertainty following the vote.

Also, while the interest rate cut theoretically made borrowing cheaper, many businesses were hesitant to take on new debt. This was mainly due to Brexit’s potential long-term impact on trade and regulation.

As a result, many businesses focused on maintaining cash reserves rather than investing in growth.

COVID-19 pandemic (2020)

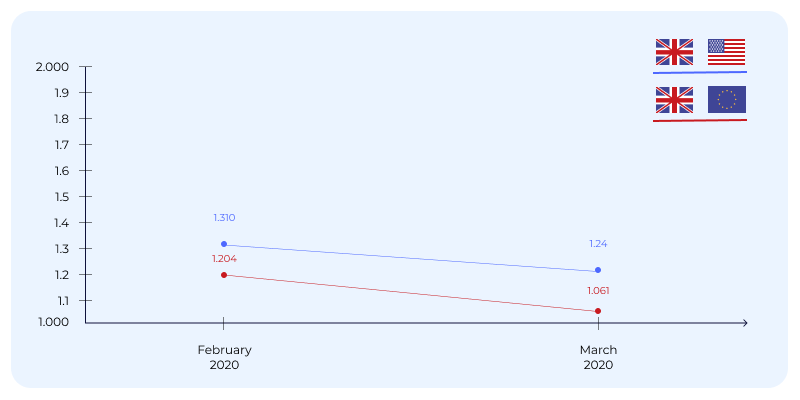

As lockdowns were announced across the UK, the Bank of England acted swiftly to support the economy.

In March 2020, the BoE cut rates twice in quick succession, bringing them down from 0.75% to 0.1%.

The pandemic created massive global uncertainty and lockdowns stunted economic activity. In response, currency markets became volatile with the pound initially dropping as investors sought safer assets like the US dollar.

Impact on the pound

GBP/USD fell from around 1.31 in February 2020 to as low as 1.24 in March 2020, reflecting the sudden flight to safety and concerns about the UK’s economic resilience.

What did this mean for businesses?

The rapid rate cuts and economic fallout from the COVID-19 pandemic had significant effects on UK businesses.

UK importers experienced increased costs due to a weakened pound and supply chain disruptions caused by lockdowns.

Despite the BoE slashing rates, helping to make borrowing cheaper, many businesses were more focused on survival than expansion. Liquidity became a major concern with many businesses seeking emergency funding or government support just to stay afloat.

UK exporters experienced some benefit from the weaker pound, making UK goods more attractive internationally, though global demand was limited due to the widespread economic impact of the pandemic.

These examples highlight the impact of significant shifts in the pound’s value following interest rate changes during dramatic events. But it’s important to note that even small shifts in the pound’s value following interest rate decisions can have noticeable effects on businesses.

Let’s dig into how interest rates affected the pound in 2024 and what this could mean for UK businesses going forward.

How have interest rates affected the pound so far in 2024?

2024 saw the Bank of England finally reap the rewards of two years of interest rate hikes. Having peaked at 9.6% in October 2022, inflation was heading towards the BoE’s 2% target, reaching 2.8% in May 2024.

Interest rates had risen from 0.1% in November 2021 to 5.25% in August 2023. The BoE then held rates steady until August 2024 where the UK saw a 0.25% cut to 5% as confidence in inflation’s downward trajectory rose.

Markets were on the fence heading into the BoE’s decision on August 2024. Analysts knew the inflation rate was close to the BoE’s target and that a rate cut could be on the horizon after 12 months without movement.

As a rate cut hadn’t been priced in, GBP/USD saw a significant drop on the day of the vote of 0.7% from 1.284 to 1.275.

It presented a great opportunity for UK exporters and any business with high volumes of foreign currency looking to convert to GBP.

As we look ahead to the rest of 2024 and beyond, it appears unlikely that we’ll see any interest rate hikes, but we could see rates held or cut. Let’s evaluate some of the potential outcomes and what they could mean for businesses.

How could interest rate cuts affect the pound in 2024 and beyond?

Following a rate cut in August, the Bank of England faces another crucial decision in September 2024.

Inflation rose slightly by 2.8% to 3.1% from June to July, which may prompt some caution. The BoE’s governor Andrew Bailey was also quoted in late August saying “it’s too early to declare victory” over inflation.

As a result, markets began pricing in an interest rate hold for September in late August. This meant the pound began to strengthen against other major currencies, with GBP/USD reaching 1.325 on 27th August 2024, its highest level since March 2022.

The pound’s rise was also likely boosted by Jay Powell, chairman of the Federal Reserve (Fed) which controls interest rates in the US, showing a different sentiment to Andrew Bailey. On 23rd August 2024, he was quoted as saying, “the time has come” for inflation cuts.

If the Fed begins to reduce interest rates while the BoE holds steady, we could see a prolonged period of strength for the pound against the dollar.

This, of course, depends on other factors such as the health and stability of the UK economy compared to the US, as well as geopolitical developments and potential shifts in investor risk appetite.

With the future unclear, it’s essential businesses manage currency risk effectively to maximise profits and protect costs.

At Privalgo, we help businesses like yours limit the risk of currency volatility and help you capitalise on favourable moments in the market.

Get in touch to find out more about how we can help your business manage FX risk and grow globally.

Conclusion

This article highlights why it’s crucial for businesses to understand how interest rates affect the pound.

While higher interest rates often strengthen the pound, and lower rates tend to weaken it, the reality is influenced by various factors, including market expectations, the health of the UK economy, and global financial conditions.

As seen in past events like the 2008 financial crisis, Brexit, and the COVID-19 pandemic, significant shifts in the pound’s value can have profound effects on businesses, from increased costs for importers to opportunities for exporters.

As we look to the remainder of 2024 and beyond, the potential for further interest rate changes, or a lack thereof, emphasises the importance of proactive FX risk management.

At Privalgo, we can help your business navigate these challenges, offering tailored strategies to protect you from currency volatility and capitalise on market opportunities.

Contact us by filling out the form above to learn how we can support your business in achieving global growth.

10 FAQs about how interest rates affect the pound

What happens when interest rates rise?

When interest rates rise, it becomes more expensive for people and businesses to borrow money, which can lead to reduced spending and lower inflation. Additionally, higher interest rates often attract foreign investment, which can strengthen the value of the pound.

Why raise interest rates when inflation is high?

Central banks increase interest rates to lower inflation when it reaches an unfavourable level. Higher interest rates make borrowing more expensive, which can reduce spending and slow down the economy, helping to bring inflation down to target levels.

What is the interest rate in the UK in 2024?

As of August 2024, the Bank of England set the interest rate at 5.0% after a series of hikes that peaked at 5.25% in August 2023. The BoE then implemented a 0.25% cut on 1st August 2024 as confidence in the downward trajectory of inflation grew.

Are UK interest rates expected to fall?

While it’s uncertain, there is speculation that UK interest rates could remain steady or experience further cuts, depending on inflation trends and economic conditions in the latter part of 2024.

How do interest rates affect the value of the pound?

Interest rates impact the value of the pound by influencing foreign investment. Higher interest rates tend to attract foreign investors, boosting the demand for the pound and increasing its value. Conversely, lower rates can lead to a decrease in the pound’s value as investors seek higher returns elsewhere.

What happened to the pound during the 2008 financial crisis?

During the 2008 financial crisis, the Bank of England aggressively cut interest rates from 5% to 0.5%. This led to a significant drop in the pound’s value, with GBP/USD falling by over 30% as investors moved to safer assets like the US dollar.

How did Brexit affect the pound?

Following the Brexit referendum in June 2016, the uncertainty surrounding the UK’s exit from the EU, combined with a rate cut from the Bank of England, led to a sharp drop in the pound’s value. GBP/USD fell from 1.44 to around 1.31 as investors became concerned about the UK’s economic outlook.

How did the COVID-19 pandemic impact UK businesses in relation to interest rates?

During the COVID-19 pandemic, the Bank of England cut rates to 0.1% to support the economy. However, the weakened pound and supply chain disruptions increased costs for importers. Some exporters benefited from the pound’s lower value, making UK goods more attractive internationally.

What factors besides interest rates affect the pound’s value?

The value of the pound is influenced by various factors beyond interest rates, including market expectations, the health of the UK economy, and global financial conditions. For example, geopolitical uncertainty and risk-off market sentiment can cause the pound to weaken, regardless of the UK’s interest rates.

How do market expectations influence the pound before a Bank of England decision?

Market expectations can cause the pound to rise or fall in anticipation of a Bank of England interest rate decision. If markets expect a rate cut, the pound may weaken before the vote is announced, as investors adjust their positions. If the actual decision differs from market expectations, it can lead to significant movement in the pound’s value.

*This article is for information purposes only and should not be regarded as financial advice.