The payments sector is continuously evolving. And new payment trends are constantly emerging. Recent years have seen paper become a thing of the past. Even credit cards and bank transfers feel close to reaching their expiry dates.

It’s all thanks to new technologies and fresh practices pushing payments in a digital direction. Now, we’re seeing a shift in focus to one that targets convenience, globalisation, technological innovation, and security.

In this article, we’re digging into some key payment trends that could play a role in the next decade.

Jump to a section:

- From your pocket to an e-wallet

- Buy now, pay later trends

- Online payment security

- International payments

From your pocket to an e-wallet

E-wallets, also known as digital wallets, allow users to store and spend money digitally. They can hold real money linked to a payment card as well as coupons or vouchers.

E-wallets securely store your payment information and passwords, so you’ll never need to carry a card again.

International e-wallets

Digital wallets are starting to take centre stage in the way we pay and transfer funds. But their uses stretch far beyond saving time at the checkout.

E-wallets may be the answer to a cross-border banking issue that’s historically disjointed and tricky to navigate.

Traditionally, opening an international bank account with a bank was a tedious process. And the resulting transactions were slow.

Now, FinTech companies are helping businesses speedily open their own international accounts containing a multi-currency IBAN and virtual IBAN.

E-wallets then step in to streamline same-day payments. They allow businesses to manage funds, store multiple currencies, and execute rapid payments or exchange currencies.

Discover the Privalgo E-wallet for simple and secure international payments.

E-wallet market

Big Tech companies like Apple, Samsung and Google are already strong players in the global e-wallet market. They provide digital wallets to their users automatically by integrating them into their smart devices.

Similarly, retail giants like Alibaba and Walmart are getting involved. Their e-wallets encourage customers to ditch the cards and shop in store with just a mobile device.

With businesses of this size playing a part, there’s no wonder the global e-wallet market is expected to soar in the coming years.

According to a research report from Transparency Market Research (TMR), the digital wallet market is estimated to grow at a compound annual growth rate (CAGR) of 22.2% between 2022-2031.

Additionally, the global mobile wallet market was valued at over $1.8trn in 2021. This is expected to increase to $16.2trn by 2031.

We’ll undoubtedly see e-wallets develop in the next decade and become an integral part of global payments.

Buy now, pay later trends

Buy now, pay later (BNPL) methods are becoming increasingly popular in a range of market sectors. We’ve seen retail, travel and entertainment already welcome it with open arms.

While the popularity of BNPL was already gaining traction, the Covid-19 pandemic sparked a surge in the trend. According to the Financial Conduct Authority (FCA), purchases using BNPL grew to £2.7 billion in 2020 – four times greater than pre-pandemic levels.

Largely, this will be down to shoppers being nudged online after lockdowns kept high-street stores shut.

So, with its popularity on the up, what exactly is BNPL?

What is buy now, pay later?

BNPL allows consumers to make purchases and pay what they owe in instalments. This could be a payment every week, month, or few months. In many ways, BNPL resembles a loan – but one that typically asks for no interest.

Sellers receive the total sale price up front, while the payment scheme provider receiving the instalments takes a cut for the transaction.

Which industries use buy now, pay later?

We’ve already mentioned how BNPL trends are popping up in a range of market sectors. To get an idea of the most popular areas, we can look at research from pyments.com.

The following sectors drew the highest percentage of their sales from BNPL at the end of 2020.

- Clothing 63.5%

- Entertainment 30.3%

- Reading material 29.4%

- Household furnishing 28.7%

- Groceries 25%

- Food delivery services 21.8%

- Cleaning supplies 21.2%

- Automobile 19.9%

- Consumer electronics 17.5%

- Travel 17.4%

Buy now, pay later providers in the UK

The UK is home to plenty of BNPL providers. Many of them made a name for themselves by teaming up with well-known online retailers.

For instance, leading payments company Klarna partnered with retail giant ASOS in 2019, giving shoppers the chance to spread the costs of items bought online. The partnership helped make Klarna a BNPL household name in the UK.

Besides Klarna, businesses like Afterpay, Laybuy, and Clearpay also burst onto the UK scene and contributed to the trend’s growing popularity.

However, it’s not only the pureplay BNPL providers that are getting involved. In 2022, Monzo became the first digital bank to offer a buy-now-pay-later service with the launch of Monzo Flex.

Similarly, NatWest released NatWest BNPL in the same year to become the first high-street bank to join the trend.

Other dominant forces in UK BNPL are Apple Pay Later, Amazon (in partnership with Barclays Instalments), PayPal Pay-in-3, and Stripe.

All in all, BNPL services have become a staple method of payment in the UK, with almost 4 in 10 (37%) Brits saying they have used a buy now pay later service.

Additionally, research from the Q4 2021 BNPL survey predicted BNPL payments in the UK would grow by 50.5% on an annual basis, to reach $30bn (£23bn) by the end of 2022.

As the payment method’s popularity increases, we can expect to see BNPL become a key trend in the next decade.

Online payment security

The demand for online payments has been on the rise for some time. And the Covid-19 pandemic only catalysed its rise.

As businesses closed their doors during the lockdowns, many merchants relied on card-not-present payments to keep the cash flowing.

While this kept their physical money safe from a robber’s swag bag, the switch to digital payments created new opportunities for online fraudsters.

As a result, financial institutions started revamping their fraud prevention controls to stop online criminals in their tracks.

Online payment fraud is a serious concern. According to the Q2 2021 Feedzai Report, 93% of all fraud attempts are now carried out online.

It’s therefore essential that financial institutions implement their own authentication process to keep customers safe.

We can expect to see new approaches to online payment security become one of the key payment trends over the next decade. Here are some approaches fraud analysts are using.

The future of online payment security

First and foremost, financial institutions must be proactive with fraud prevention and online payment security.

Two ways they can keep their customers safe are through rule-based logic and machine learning (ML) technology.

Rules-based logic

Rules-based logic follows a straightforward process. It evaluates situations with an if/then approach. For example, if the IP address is present on a blacklist, then block the user from your website.

Typically, fraud analysts create rules based on factors like location, frequency, and unknown accounts. Let’s break them down.

Location – Is the transaction occurring outside the common location where the customer usually makes their purchases? How far outside the usual area is it? Is the purchase strange for that location?

Frequency – Is the user making purchases more frequently than before? Are these unusual? Has a relatively dormant account suddenly lit up with transactions?

Unknown accounts – Is the customer receiving oddly large amounts from unrecognised accounts? Is the sender a new account? Are multiple accounts being created quickly from the same IP address to send money?

Following the if/then logic, rules are created in response to questions like these. For example, if a payment from an account that typically makes purchases in London is instead coming from another continent, then the payment should be investigated or blocked.

Machine learning technology

As mentioned above, another approach to online payment security is using ML technology to detect fraud. ML is a subset of artificial intelligence (AI). It uses computers to make decisions. But while AI and ML share many similarities, the key difference is ‘learning’.

ML allows large amounts of data to be analysed by computers. They then learn how to make decisions on the data in a similar way to how a human would.

The advantages of ML are that it’s fast, scalable, efficient, cheap, and accurate. It works like this.

Data is inputted into a computer and labelled as either good or bad. Good means legitimate customers with a squeaky-clean fraud history. Bad means customers with a record of chargebacks (also known as reversals) or those who have been manually listed as fraudsters.

Features are then created to describe consumer behaviour. When customer behaviour is fraudulent, it’s referred to as a fraud signal.

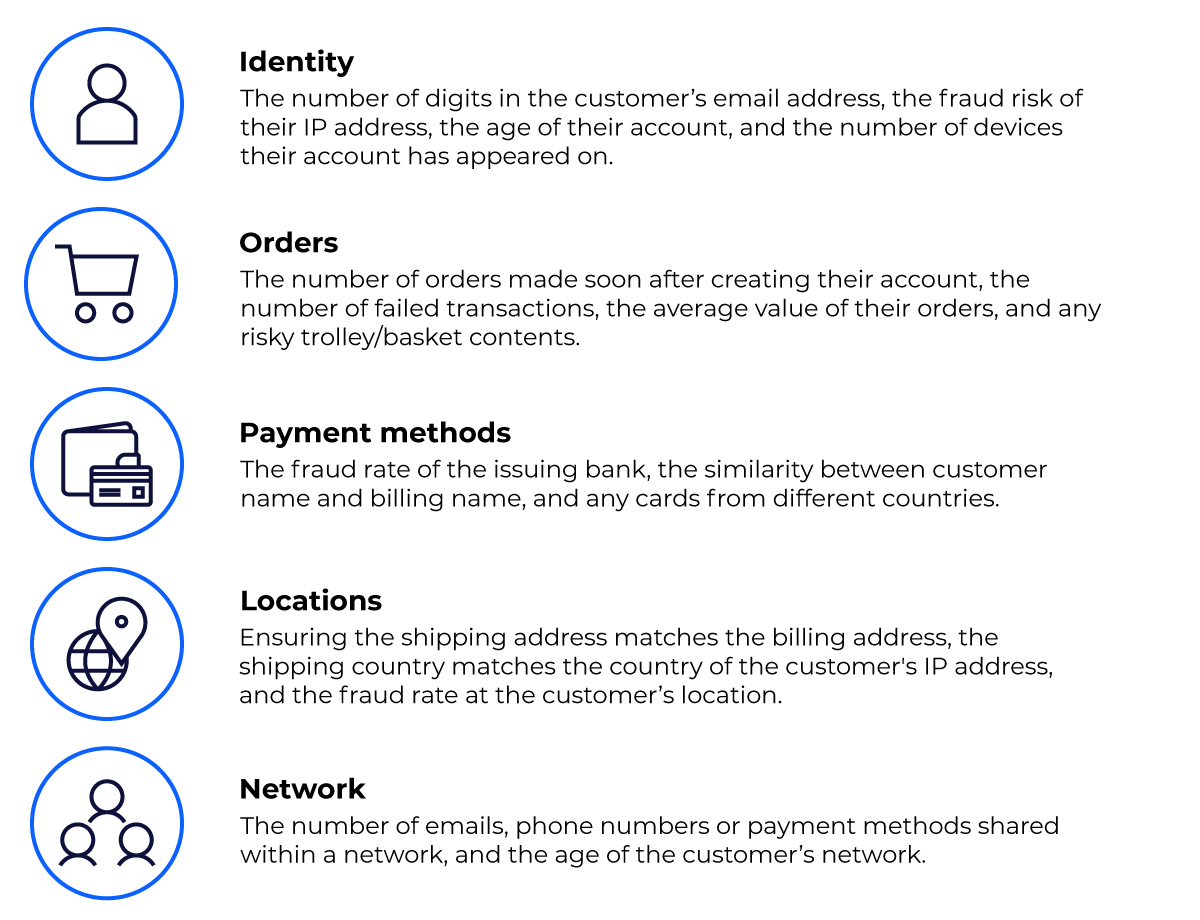

We can break down customer features into five categories:

Based on these customer features, a computer will create an algorithm with a set of rules to follow. The algorithm learns how to predict outcomes based on the data, e.g., whether a payment is fraudulent or not.

The algorithm will be trained based on historical customer data. Once the training is finished, a model is formed which can detect fraud in milliseconds.

Going forward, financial institutions may look to combine both rules-based logic and ML technology to defend against fraud.

They can utilise the sophisticated capabilities of ML as well as the flexible nature of rules-based logic. Overall, this provides customers with both a safe and efficient payment experience.

International payments

We’ve already mentioned how e-wallets are becoming a key payment trend. But there’s plenty more developing in the world of international payments and foreign exchange.

Technologically advanced online portals are giving users more visibility and control over their multi-currency transactions.

At Privalgo, our custom-made online portal, Insight, is intuitive and totally transparent. It allows our clients to make quick, accurate and cheap transactions, meaning they can spend less time on payments and more time focusing on what matters to them.

What’s more, Insight discloses the spread. This means our clients know how much we make from their international payments. It reflects our values of trust and transparency.

We also only accept online payment instructions through Insight. Never manually. This reduces the risks of human error, keeping our clients’ payments safe.

Speaking of security, we protect all international payments through two-factor authentication (2FA). This helps mitigate the risk of unwanted people gaining access to their accounts.

Book a free chat with a Privalgo Foreign Exchange Specialist to see how we can help with your business’s international payments and foreign exchange requirements.

Book a chat