Businesses have been looking for ways to streamline their cross-border payments for years. And in virtual IBANs, they may have found their answer.

Traditionally, managing international cashflows is a resource-heavy, time-consuming process. Through virtual IBAN accounts, businesses can improve efficiency, increase control and cut costs.

In this article, we’ll be explaining what virtual IBANs are, how they work and how they can benefit businesses.

How do virtual IBANs work?

An IBAN is a unique code used for identifying bank accounts when sending and receiving international transfers. In the UK, bank accounts give you an account number and a sort code to make domestic payments. An IBAN works in the same way but for international transfers.

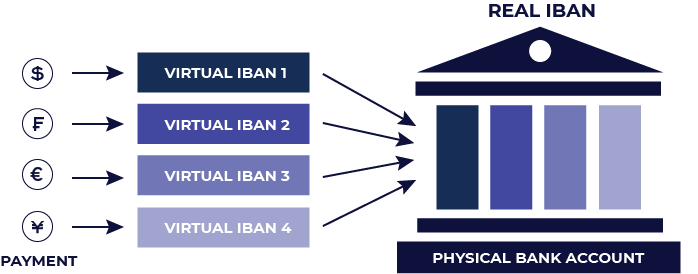

IBANs are matched directly to a bank account. In other words, you have one IBAN to one bank account. Virtual IBANs (vIBANs) are different. You can have multiple vIBANs linking to the same central bank account. Think of vIBANs as sub accounts of a master central account as shown in the image below.

If you send and receive international payments from lots of different entities, you’ll have to provide them with an IBAN and additional reference information. This is so you can track where a payment has come from.

Virtual IBAN accounts are loaded with referencing information that makes international payments easy. By distributing unique vIBANs to your payees, they’ll no longer need to add anything when they transfer money to your business.

The payment will be rerouted to your physical bank account, and you’ll know exactly where the money has come from.

What are the benefits of virtual IBANs?

Virtual IBANs can help businesses save money on their cross-border payments. Sending and accepting international payments brings large transactional costs. Businesses have to open and manage physical accounts to settle payments, which costs time and money.

Through vIBANs, businesses experience the same settlement capabilities without the need for individual, physical accounts.

As they operate entirely online, vIBAN accounts are quick and easy to set up. Applying for a business bank account with a traditional bank can be laborious. Creating a virtual IBAN account takes little time and doesn’t require you or your business to reside in the same country as your account provider.

What are virtual banks?

Virtual banks take traditional banking methods and apply them to an online service. While many major banks use online banking, virtual banks are exclusively digital. They remove in-person branches entirely.

Businesses can benefit from the convenient and speedy way accounts can be opened. Information is submitted digitally with no need to visit a physical bank.

Similarly, companies like the accessibility of virtual banks. Businesses can make domestic transfers, manage overdrafts, send money abroad, set budgets and plenty more all online. International payments tend to be cheaper too, with fewer additional fees.

Making international payments

International businesses use virtual IBANs for their convenience and cost-cutting abilities. Similarly, maximising your business’s foreign exchange (FX) strategy can save precious time and money.

Privalgo uses intelligent payment solutions to reduce the risk of FX volatility affecting your cross-border payments.

Our Foreign Exchange Specialists will get to know your business and tailor our state-of-the-art payment solutions to suit your business’s needs.

Request a callback from a Privalgo Foreign Exchange Specialist and see how we can help your business.