Shipping container industry: top 5 risk control practices

The shipping container industry remains a multi-billion-dollar sector, crucial to the global economy. Over 80% of world trade still moves by sea, making efficient financial management essential for businesses navigating the uncertainties of 2025.

With ongoing geopolitical tensions, economic fluctuations, and supply chain shifts, finance directors have plenty on their plate in 2025 and beyond.

In this article, we cover why managing risk is more crucial than ever, explore how global events have shaped the industry, and outline five key practices for finance directors.

Understanding shipping risk management

Shipping risk management is the process of identifying, assessing, and mitigating risks associated with the transportation of goods.

Due to the global nature of the industry, shipping businesses are vulnerable to a range of risks, including:

- Natural disasters (hurricanes, earthquakes, and extreme weather events)

- Economic changes (rising fuel costs, freight rate fluctuations, and shifting global demand)

- Political instability and regulation (wars, tariffs, piracy, and changing trade policies)

- Financial volatility (currency fluctuations, interest rate changes, and economic downturns)

By managing risk proactively, businesses can shield themselves from financial losses, supply chain delays, and regulatory hurdles.

Read: Importing from China to the UK: the essential guide for wholesalers in 2024.

Common risks in the shipping container industry

Best practices for finance directors in the shipping container industry

Finance directors play a pivotal role in safeguarding their businesses from risks associated with global shipping.

By integrating the following best practices, companies can better navigate industry challenges and secure financial stability.

1. Develop a shipping risk management plan

A shipping risk management plan is a blueprint for keeping risks at bay. It should be updated regularly to reflect global changes and include:

- A detailed risk assessment identifying threats such as supply chain disruptions, financial volatility, and geopolitical instability.

- A strategy for risk mitigation, including risk transfer (insurance), avoidance (alternative routes), and reduction (operational efficiencies).

- A monitoring system to evaluate the effectiveness of the plan and adapt as needed.

2. Strengthen cargo security measures

With rising concerns about cargo theft and cyber threats, businesses must become tougher on their security protocols.

Best practices include:

- Using tamper-proof containers with advanced locking mechanisms.

- Marking containers with tracking codes to prevent theft and misplacement.

- Adding GPS tracking for real-time monitoring of cargo movements.

- Conducting background checks on personnel handling shipments.

3. Secure the right shipping insurance policy

Shipping insurance can help to protect businesses from financial losses during unforeseen, damaging events. It’s important to sift through the various insurance policies and find one that meets the specific needs of your company.

Below are some factors to consider:

- The value of the goods being shipped.

- The route that the goods will be shipped.

- The risks associated with the shipping route.

- The company’s financial capacity to absorb a shipping loss.

Read: CBAM regulation: the guide for UK importers.

4. Work with a reliable currency specialist

The shipping container industry is immersed in multiple currencies. A business may purchase containers in one currency, pay for fuel in a second currency, and collect payments from customers in a third.

As currency values are constantly moving, finance directors face significant challenges managing their currency costs and protecting their profits from potentially damaging swings.

Partnering with a business that specialises in understanding your company’s currency requirements can be an effective way of managing the risk of currency fluctuations.

At Privalgo, every business we work with is allocated a dedicated Relationship Manager. They help businesses manage their currency risk effectively.

In doing so, finance directors of shipping container business can have more confidence in setting budgets and forecasting, helping them plan more accurately and strengthen their bottom line.

Fill in the form below to see how our Currency Specialists can help your business manage risk and protect your profits.

Book a chat with a Privalgo Currency Specialist5. Monitor global geopolitical events and trade policies

Geopolitical instability continues to be one of the biggest risks facing the shipping industry in 2025.

The Red Sea crisis, for example, has forced many shipping companies to reroute vessels via the Cape of Good Hope, leading to increased fuel costs and extended transit times.

While the conflict in the Middle East continues, it’s essential businesses factor in any potential obstructions.

Finance directors should:

- Stay updated on trade policy changes, sanctions, and international disputes.

- Monitor key shipping lanes for disruptions caused by conflicts or government regulations.

- Diversify supply chain routes to reduce dependency on high-risk areas.

By proactively adapting to geopolitical changes, businesses can avoid costly delays and unexpected financial burdens.

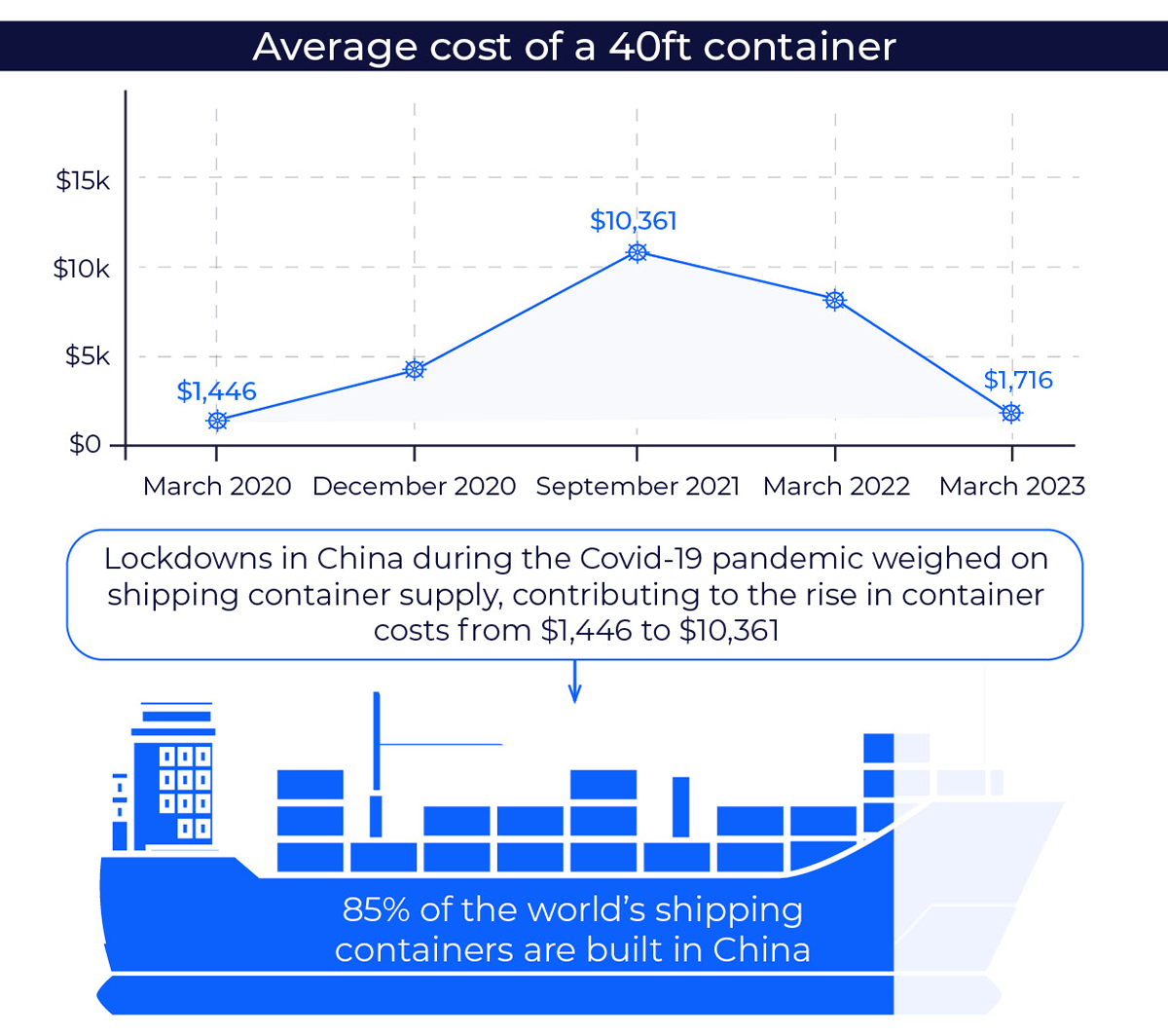

How the price of shipping containers has changed since in the last five years

Black swan events can be a key risk factor for businesses operating in the shipping container industry. Without sufficient protection against uncertainty, business can suffer critical shocks. The Covid-19 pandemic highlighted the potential damages of such events.

The average freight cost of a 40ft container in March 2020 was $1,446, just as lockdowns came into force worldwide. In September 2021, freight costs soared by 616% to peaks of $10,361.

The easing of lockdowns made demand for shipping containers rise dramatically and questions arose over whether the high prices would hinder economic recovery. This was due to several factors.

Reopening economies

As economies started to reopen, businesses and consumers began to order more goods from overseas, elevating demand for shipping containers.

The shift to online shopping

While much of the world was stuck as home, online shopping became a new habit. In February 2021, 75% of UK shoppers said they had been shopping more online than they had been before Covid-19. This boosted demand for goods from overseas.

Shipping container shortages

The pandemic also led to a shortage of shipping containers. The shortages were catalysed by multiple factors, including:

- Closed factories: Factories that make shipping containers were forced to close during the pandemic, reducing the supply of containers. 85% of the world’s shipping containers are built in China which saw long, widespread lockdowns as the country instilled its zero-Covid policy.

- Diverted containers: Containers that were already in use were diverted to other routes, which further damaging supply.

- Increased demand: The surge in demand for shipping containers outpaced the supply, which led to a sharp increase in prices.

These factors contributed to the significant increase in prices on shipping containers, impacting businesses and consumers alike.

The pandemic was a huge shock to the system for businesses in the shipping container industry. Its impact on global trade highlighted the importance of risk management in the sector.

Red sea crisis 2024

While shipping container prices gradually declined as the pandemic eased worldwide, they experienced another sudden spike in 2024.

Following attacks from Houthi militants in the Red Sea – a significant trade route for goods between Europe and Asia – many shipping companies were forced to reroute their cargo via Cape of Good Hope in South Africa.

The significant diversion resulted in a sharp increase in journey time for ships, adding an additional 14 to 18 days per journey. This increase in time led to a shortage of available containers, and prices jumped from $1,661 in December 2023 to a peak of $5,927 in July 2024.

Similarly to the fallout from the Covid-19 pandemic, the Red Sea crisis’s impact on container costs further emphasis why risk management is so crucial for businesses to survive and thrive.

Read: What are tariffs and restrictions in global trade?

Summarising shipping container risk management

Risk management is an essential part of any business, but it’s especially important for businesses that operate in the shipping container industry.

The global nature of the shipping container industry exposes businesses to a wide range of risks, including natural disasters, political instability, financial volatility, and black swan events.

By following the best practices outlined in this article, finance directors can mitigate risks and protect their businesses from financial losses.

At Privalgo, our dedicated team can help you manage currency risk and protect your profits from suffering in times of uncertainty. Contact our Currency Specialists today to find out how we can help your business grow globally.

10 FAQs about shipping container risk management

Below are 10 frequently asked questions about risk management in the shipping container industry. The answers to these questions may use content already discussed in this article.

How much did a 40-foot shipping container cost in 2024?

In 2024, the cost of a 40-foot shipping container varied based on its condition, its availability, and market demand.

According to Statista, the cost of a 40-foot shipping container fluctuated in 2024 from lows of $2,670 to highs of $5,937.

Are shipping container costs rising in 2025?

As of early 2025, shipping container costs have experienced fluctuations.

The latest information available at the time of writing suggests shipping container costs are currently decreasing.

The Drewry World Container Index reported a 3% decline to $2,541 per 40ft container as of 6th March 2025. This rate is 76% below the pandemic peak of $10,377 in September 2021 but remains 79% higher than the average rate in 2019 of $1,420.

What factors influence shipping container prices?

Several factors impact the cost of shipping containers such as size and type, condition, location, and market demand.

How did the Covid-19 pandemic affect shipping container costs?

The COVID-19 pandemic led to significant disruptions in global supply chains, causing container shortages and soaring prices. The average freight cost of a 40-foot container increased from $1,446 in March 2020 to a peak of $10,361 in September 2021, leaping by 616%.

Will shipping container costs go down in 2025?

Early data for 2025 shows a decrease in the cost of freight rates since the end of last year. Following a volatile 2024, time will tell whether this trend will continue or if similar fluctuations could be on the horizon.

How do geopolitical events impact shipping container costs?

Geopolitical events, such as conflicts affecting major shipping routes, can lead to increased transit times, higher fuel consumption, and elevated shipping costs.

For example, attacks in the Red Sea region in 2024 prompted many shipping companies to reroute vessels via the Cape of Good Hope, resulting in longer journeys, increased expenses, and limited container availability, driving up costs.

What are the best practices for managing risks in the shipping container industry?

Effective risk management practices include:

- Developing a comprehensive risk management plan: Identifying potential threats and outlining mitigation strategies.

- Strengthening cargo security measures: Implementing advanced locking mechanisms, GPS tracking, and thorough personnel background checks.

- Securing appropriate insurance coverage: Tailoring policies to the specific needs and risks of the business.

- Partnering with reliable currency specialists: Managing currency fluctuations to protect profits.

- Monitoring geopolitical events and trade policies: Staying informed to anticipate and adapt to potential disruptions.

How can businesses mitigate the impact of currency fluctuations in the shipping industry?

Businesses can mitigate currency risks by collaborating with currency specialists to take advantage of foreign exchange products like forward contracts that lock in favourable rates of exchange and bring more confidence to a business’s costs.

How important is insurance in the shipping container industry?

Insurance is crucial in protecting businesses from financial losses due to unforeseen events such as cargo damage, theft, or delays. Selecting the right policy involves assessing the value of goods, shipping routes, and the company’s capacity to absorb potential losses.

How do natural disasters affect the shipping container industry?

Natural disasters can disrupt port operations, delay shipments, and damage infrastructure, leading to increased shipping times and costs. Implementing robust risk management plans helps businesses prepare for and mitigate the impacts of such events.

This article is for information purposes only and should not be considered financial advice.