What is a black swan event?

In short, black swans are highly unpredictable events that carry a severe impact.

They are situations that seem impossible, mainly because nothing in the past suggests they are coming.

When black swan events happen, they have an extreme effect. There are many ways this effect can be felt, but we’ll be focusing on events that have an economic impact.

Crucially, one of the fundamental elements of a black swan event is hindsight. Despite nothing from the past suggesting a black swan event is about to happen, people will create explanations after the event has occurred making it seem plausible and predictable.

Black swan principles:

- Rarity: the event is highly unpredictable because nothing in the past hints at its possibility.

- Extreme impact: the consequences of the event have a severe effect.

- Retrospective predictability: people create explanations after the event to make it seem predictable.

In this article, we’ll be discussing black swan theory, some black swan examples, and how businesses can protect against unpredictability.

Black swan meaning and theory

The notion of a black swan was made famous by finance professor, former Wall Street trader, and author Nassim Nicholas Taleb. His book, titled ‘The Black Swan: The Impact of the Highly Improbable’, suggests some catastrophic events are impossible to predict and trying to foresee them can do more harm than good.

The idea is that, by assuming we can predict black swan events, we leave ourselves more vulnerable to real black swan events. Committing too much attention, effort and money to something we assume is predictable means we’re more likely to get caught out by something entirely unpredictable.

Taleb published the first edition of ‘The Black Swan’ in 2007, just before the financial crisis of 2008. In a later, revised edition, he used the crash to explain how his black swan theory applies to systems as a whole.

The global financial crash in 2008 is an example of what can happen when finance systems are not allowed to fail.

By heavily shielding a system from the possibility of failure – to defend against what is considered predictable – it becomes more vulnerable to serious, devastating loss.

It’s an example of the illusion of stability.

Black swan theory encourages systems to cater for regular, small knocks to protect themselves from extreme damages. This is a method used by Taleb in his days as a trader.

He took frequent, small losses on many of his investments. But his willingness to accept ‘failure’ put him in a strong position to capitalise on dramatic movements – rather than suffer – when they came.

How do black swan events affect currencies?

Currency markets, like any finance system, are prone to the effects of black swan events. Let’s revisit the financial crisis of 2008 and examine the impact it had on currencies.

If you’re familiar with Michael Lewis’ ‘The Big Short’, you’ll know the impending doom of America’s banking system was predicted by a handful of people.

However, the collapse deceived most of the American population, and the severity of the crash made it a true black swan event.

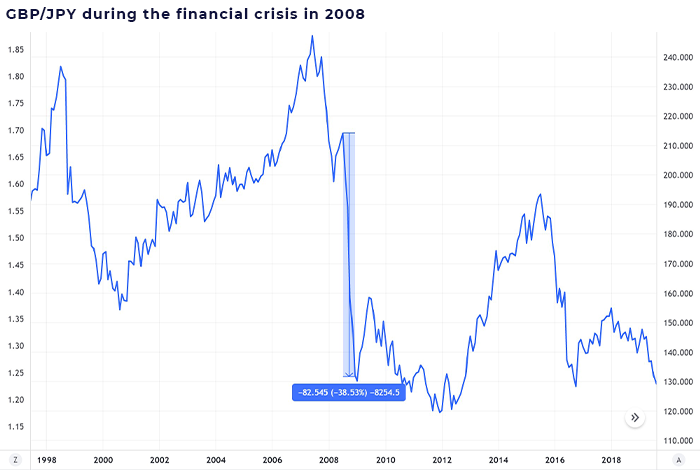

When Lehman Brothers went bust in September 2008, currency markets felt the full effects. Investors fled to safe haven currencies like the Japanese yen (JPY), abandoning riskier assets like the Great British pound (GBP).

The GBP/JPY currency pair wobbled in July before plunging two months later. Between July and December 2008, the pound had fallen by more than 38% against the yen.

The shift remains the most significant movement in the pair’s history.

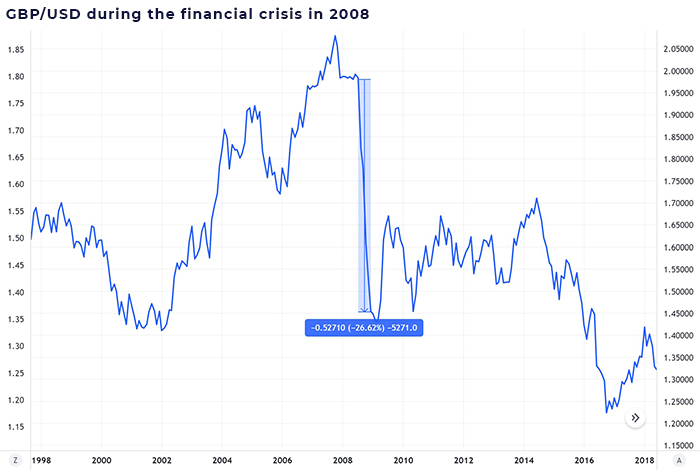

Similarly, despite the economic crash occurring on American soil, the risk-off US dollar (USD) made substantial gains against riskier currencies.

The GBP/USD currency pair dropped more than 26% between July and December. Put differently: one pound would get you almost two dollars (around 1.98) in the months before the crash. By the end of the year, one pound would get you less than 1.5 dollars (roughly 1.45).

Movements like this are extreme in currency trading. The impact of black swan events like the 2008 financial crisis can have significant effects on the currency markets.

Black swan event examples

So far, we’ve only spoken about one example of a black swan event. But there are plenty more we can look into.

Conflict in the Middle East

On 7th October, 2023, Hamas launched an unpredictable attack on Israel, triggering a brutal war in Gaza that sent shockwaves through global markets. Investors scrambled to adjust, and currency markets felt the impact.

The Israeli shekel (ILS) was hit the hardest. The currency plunged to an eight-year low against the US dollar before the Bank of Israel stepped in, announcing a $30 billion intervention to stabilise it. The shekel’s initial tumble reflected investor anxiety, but the central bank’s aggressive action helped limit further damage.

Elsewhere, the risk-off dollar and Swiss franc gained traction, as geopolitical instability sent investors flocking to safe-haven assets. The yen – traditionally a safe-haven currency – saw mixed performance due to Japan’s own economic struggles.

The situation escalated further when Houthi rebel attacks on Red Sea shipping routes forced global trade to reroute around Africa’s Cape of Good Hope. This drove up shipping costs, contributed to inflation fears, and put added pressure on currencies of emerging market economies.

Much like the Russia-Ukraine war in 2022, the Israel-Gaza conflict demonstrated how geopolitical black swans can send currency markets into a frenzy, creating significant opportunities – and risks –for traders and businesses alike.

Read: Shipping container industry: Top 4 risk management practices

Hyperinflation in Zimbabwe

In 2008, Zimbabwe experienced one of the worst cases of hyperinflation in history. Inflation had strangled its currency for over a decade. But when hyperinflation eventually kicked in, the value of the Zimbabwean dollar collapsed.

Zimbabwe reached a peak inflation rate of 79.6 billion per cent – a level so severe that it had to abandon its old money and temporarily adopt foreign currencies. It’s almost impossible to predict such a catastrophic level of inflation.

Read: How does inflation affect exchange rates?

The dot-com bubble

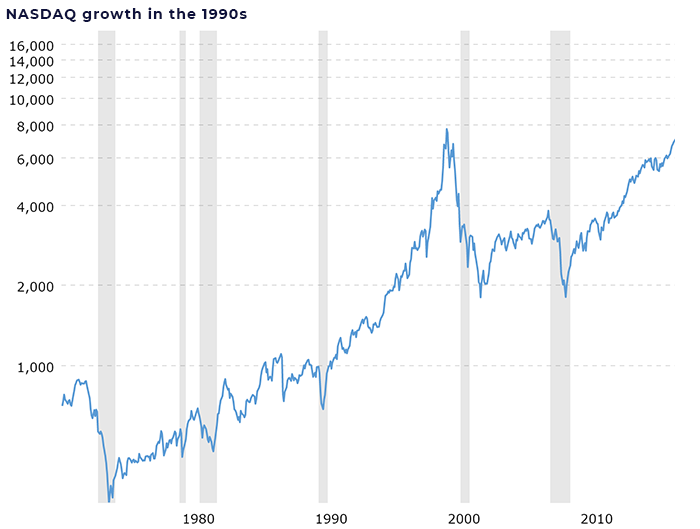

The dot-com bubble of 2001 is another black swan event. The rapid technological advances of the 1990s had investors purring at up-and-coming tech businesses. The Internet was the new kid on the block and created massive overvaluations of such companies.

Investment funds pumped vast amounts of money into tech businesses that failed to deliver the goods. The companies folded, and funds were hit hard.

Eventually, the bubble burst and the American economy plummeted. The nature of the new digital world made the dotcom bubble unpredictable, and the impact devastating.

Importantly, not all black swan events are bad. The definition of a black swan event states that it has an extreme impact. This isn’t always a negative thing. For example, the surprisingly strong growth of the Nasdaq stock exchange in the late 1990s can be described as a black swan event.

In general, positive black swans take a bit more time to show their effects. The growth of the Nasdaq took a few years in the 1990s but looks sharp on a historical timeline.

Despite the growth eventually leading to the dotcom bubble, the Nasdaq’s progress through the 90s will have brought some positivity on its way.

Was Covid-19 a black swan event?

At face value, the Covid-19 pandemic seems a certain black swan event. It is frequently used as an example of the most recent black swan occurrence. However, the Covid-19 pandemic was more predictable than you might think.

It was heavily documented that Bill Gates and Laurie Garrett predicted the global spread of Covid-19. And a worldwide pandemic came as no surprise to some institutions.

According to Sports Pro Media, the All England Lawn Tennis Club (the organisers of Wimbledon) had been paying into pandemic insurance since 2003, and received a tournament cancellation payout of £157m in 2020.

Another person to have predicted the Covid-19 pandemic was Nassim Nicholas Taleb.

Taleb co-wrote a paper on 26th January 2020 (when the Covid-19 was only in China), warning governments about the risks of the virus. According to Taleb and his co-authors, the key factors that made the Covid-19 pandemic predictable were increased connectivity and nonlinearity.

Taleb has focused on connectivity in recent years and strongly believes we are overconnected with each other. Physical overconnectivity leaves us open to things like pandemics, while virtual overconnectivity exposes us to risks from computer viruses and information attacks.

The nonlinear nature of the virus (its unknown contagiousness, severity and ability to mutate), combined with our worldwide connectivity, created the perfect recipe for a global pandemic.

Because of this predictability, Taleb – the pioneer of the term ‘black swan’ – is adamant that the Covid-19 pandemic is not a black swan event.

To you or us, the devastation from the Covid-19 pandemic went far beyond the parameters of expectation. So, if the Covid-19 pandemic is not a black swan event, perhaps it can be better described as a grey swan event.

What is a grey swan event?

A grey swan event shares similarities with a black swan event. However, where a black swan event is highly unpredictable, a grey swan is somewhat predictable – but highly unlikely. Similarly to black swans, grey swans can have massive effects on economies and society.

We’ve already suggested that the Covid-19 pandemic is a grey swan event, so let’s compare it to some other examples.

When the UK voted to leave the European Union in June 2016, the value of the pound plummeted. Within 24 hours of the announcement, the pound dropped over 8% against the euro and just under 12% against the dollar.

The watching world was well aware of a possible ‘Leave’ victory. But the strong unlikelihood of the outcome resulted in profound effects. It can be considered a grey swan event.

Similarly, when Donald Trump walked away victorious from the US presidential election in November 2016, it was not an unpredictable event – but a highly improbable one. The same can be said for his re-election eight years later in November 2024. The impact on society, both nationally and internationally, was substantial.

So, where there are similarities between black swans and grey swans, there are also noticeable differences. But without question, both possess the power to have drastic impacts on the world around us. And chances are, we won’t even see them coming.

Protect against unpredictability with Privalgo

As we’ve made clear in this article, trying to predict black swan events can have dangerous consequences. But protecting yourself from unpredictability is possible – and encouraged.

Early 2025 has seen considerable uncertainty, driven by war in Ukraine and the Middle East continuing, and a barrage of trade tariffs as part of Trump’s ‘America First’ ideology.

Now could be a crucial time to protect your business from uncertainty – and future black swan events.

At Privalgo, our foreign exchange (FX) solutions can help your business protect against currency market risk and capitalise on opportunities. You can utilise FX products such as forward contracts and market orders as part of an FX strategy to protect your profits and scale with confidence.

Contact us to speak with a Privalgo Currency Specialist today and learn how we can help your business grow globally.

10 FAQs about black swan events

Below are 10 frequently asked questions about black swan events. Some of the answers feature content already used in this article.

What is a black swan event in finance and how does it impact businesses?

A black swan event is an unpredictable occurrence with severe economic consequences. Businesses can suffer from currency volatility, supply chain disruptions, and market uncertainty following such events.

How do black swan events affect currency exchange rates?

Black swan events often cause investors to shift funds into safe-haven currencies like the US dollar (USD), Swiss franc (CHF), or Japanese yen (JPY), while riskier currencies experience sharp declines.

What are some recent black swan events that have impacted the global economy?

Notable recent black swan events include the Russia-Ukraine war in 2022, the Israel-Gaza war in 2023, and the global COVID-19 pandemic, all of which sent currency markets into turmoil.

How can businesses protect against black swan events in currency markets?

Businesses can use risk management solutions, such as forward contracts, to lock in exchange rates and safeguard against extreme currency fluctuations.

Which currencies are most affected by black swan events?

Emerging market currencies, such as the Argentine peso (ARS), Turkish lira (TRY), and South African rand (ZAR), are often hit hardest due to weaker economic stability.

Is a black swan event coming?

While black swan events are inherently unpredictable, signs like rising geopolitical tensions, extreme stock market speculation, and global trade disruptions may indicate increased financial risk.

How do central banks respond to black swan events?

Central banks may intervene in currency markets, adjust interest rates, or introduce stimulus measures to stabilize financial conditions and prevent economic collapse.

What is the difference between a black swan event and a grey swan event?

A black swan event is completely unexpected, while a grey swan event is unlikely but somewhat foreseeable, such as Brexit or trade wars.

How can businesses maintain international trade during black swan currency shocks?

Businesses should diversify supply chains, use multi-currency accounts, and implement risk management strategies to avoid major disruptions.

Can black swan events be predicted?

While black swan events are, by definition, unpredictable, some analysts and risk managers attempt to identify warning signs before a crisis unfolds. However, predicting a black swan event with certainty is nearly impossible.

*This article is for information purposes only and should not be considered financial advice.