How global payroll solutions are driving business growth

In today’s interconnected world, businesses are increasingly employing more and more remote workers, many of which are overseas.

By extending their workforce globally, businesses can access more highly skilled workers and expand their operations worldwide.

But while international employees are fundamental for ambitious global businesses, paying a diverse workforce comes with its challenges.

Fortunately, advancements in technology mean modern payroll solutions are streamlining the process, ensuring remote workers are paid accurately, on time and in their local currency.

This article explains what payroll is, how it works and an example of how Privalgo’s global payroll solutions can help save your business significant time and resources.

What is payroll and how does it work?

Payroll is essentially the process businesses take to ensure their employees are paid for the work they’ve completed.

This involves calculating wages, withholding taxes and deductions, and distributing payments. Here’s how it typically works:

- Data collection: Collecting employee information, including hours worked, salaries, and applicable deductions.

- Wage calculation: Calculating gross wages based on hours worked or salary agreements.

- Deductions: Withholding taxes, social security, and other deductions such as health insurance or retirement contributions.

- Net pay calculation: Determining the net pay after all deductions.

- Payment distribution: Distributing payments to employees via direct deposit, checks, or other payment methods.

- Reporting: Preparing and filing necessary tax and compliance reports.

How modern payroll solutions combat the challenges of old

Driven by technological developments, modern payroll solutions have become more accessible and affordable for businesses today.

Let’s break down the key factors optimising the payroll process.

Multi-currency payroll capabilities

In today’s world, businesses can make payments to their employees in multiple currencies. This is a massive boost for finance managers handling global payroll as it eliminates the need for manual currency conversions.

Also, using multi-currency payroll solutions from a foreign exchange (FX) specialist like Privalgo can be cost-saving due to competitive exchange rates.

Automatic payroll

Automation is a big one when it comes to modern payroll systems. By automating payroll processes, businesses can reduce manual data entry, reduce errors, and ensure compliance with payroll regulations. This efficiency saves time and resources, allowing businesses to scale their operations more effectively.

Compliance and reporting features

Staying on top of local tax laws and labour regulations is critical in payroll management. Modern payroll solutions may include features that automatically update to reflect changes in legislation, ensuring businesses remain compliant.

If you’re based in the UK, the Gov website has some useful content for keeping on top of tax laws and regulations.

Additionally, advanced reporting tools provide detailed insights into payroll activities, helping businesses track expenses and maintain accurate records.

Integration with existing systems

Being able to integrate global payroll solutions with existing HR and accounting systems makes life a lot easier for payroll managers.

Many modern payroll solutions offer application programming interfaces (APIs) and other integration tools that allow businesses to connect their payroll software with other systems, ensuring data flows smoothly and errors are kept to a minimum.

Choosing the right payroll solution for your business

There’s plenty to consider when choosing which payroll solution will work best for your business.

Think about the size of your workforce, the complexity of your payroll needs, and your budget. Look for solutions that offer scalability, flexibility, and helpful customer support to ensure they can grow with your business.

Let’s dive deeper into what to pay attention to.

Customisation and scalability

Make sure you work with a provider that offers customisable payroll solutions to meet your specific needs.

Whether you need to manage different pay structures, handle multiple currencies, or comply with various local regulations, a flexible solution will adapt to your requirements.

Scalability is also crucial, as your payroll needs may grow as your business expands.

Security and data protection

Payroll data is highly sensitive, so it’s essential to choose a solution that prioritises security. Look for features such as encryption, multi-factor authentication, and regular security audits to protect your data from breaches and unauthorized access.

Now, let’s take a look at global payroll solutions in action and see how they can help businesses like yours save time and valuable resources.

Case study: How Privalgo streamlined global payroll for thousands of employees

Client: A leading payroll provider for remote employees

Industry: Payroll services

Challenge: Efficiently managing international payroll payments

Solution: Privalgo’s high-tech client portal and foreign exchange capabilities

Our business in focus is a UK-based payroll provider specialising in managing payroll for businesses with remote employees. The biggest challenge they faced was efficiently processing their international payments.

Previously, their payment process involved manual transactions for each individual employee of their clients, using up crucial time and resources. They required a more streamlined solution to handle their growing payroll needs effectively.

The challenge

Before working with Privalgo, the business used a different foreign exchange provider to pay their clients’ employees in different currencies. As they paid employees all over the world, they required Pound Sterling (GBP), US Dollars (USD), Canadian Dollars (CAD), Malaysian Ringgits (MYR), Indian Rupees (INR), Australian Dollars (AUD), and New Zealand Dollars (NZD).

While the exchange rates they received were competitive, the process was heavily time-consuming. Transactions had to be sent manually for each individual.

This inefficiency was particularly problematic as their clientele grew, with employees spread across different countries and currencies. The business’s requirement of 10,000 payments per month meant a dedicated team of multiple people committed 3-5 working days to process all payments.

Their key pain points included:

- Time-consuming processes: Manual payment processes were slow and labour-intensive.

- Lack of automation: There was no automated way to handle thousands of payments.

- Currency management: Managing payments in different currencies added complexity and more room for error.

- Reporting challenges: Accessing and customising payment reports was difficult and congested with unnecessary data.

The solution

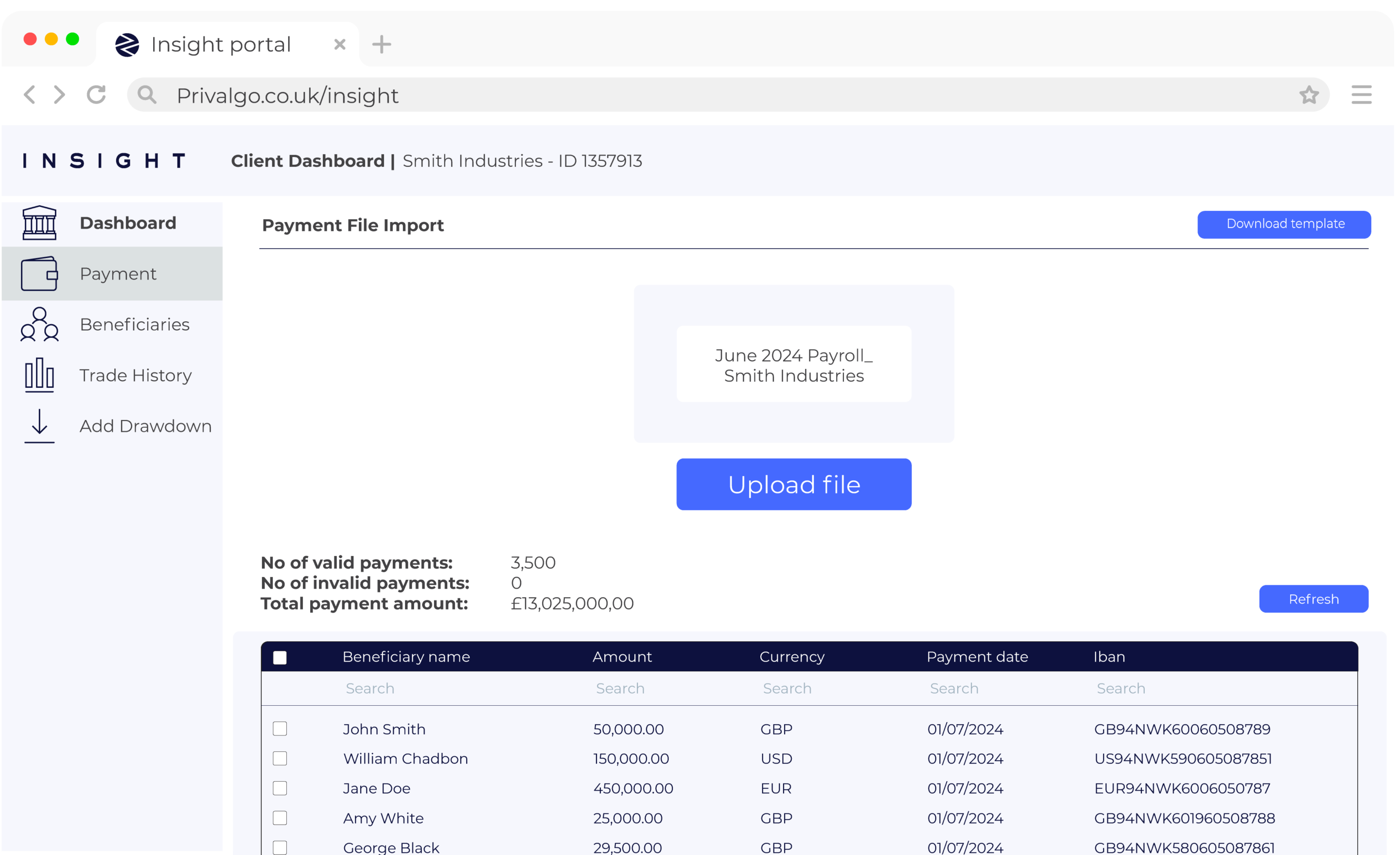

To help ease our client’s headaches, we introduced them to our high-tech client portal. The portal significantly streamlined the payroll process for the business through our innovative File Upload and Bulk Payments features.

File Upload: Clients can upload an Excel or CSV spreadsheet containing thousands of payment data with a single click. This simplifies data entry and reduces manual input errors.

Bulk Payments: Once the data is uploaded, another click allows the client to send fast, accurate payments to all employees on the spreadsheet. This also works for payments in multiple currencies as we handle the FX automatically. It was ideal for the business’s clients with international remote workers.

Confidentiality: It’s important to mention that we maintain total confidentiality of our clients’ data through our secure online portal. Clients must log in with two-factor authentication (2FA) and a lead user determines access permissions for other users. By following this process, we ensure confidential data is only handled by authorised people.

Read our privacy and data protection guidelines.

Additional features:

Customisable reporting: Clients can access, download, and customise reports of their payment activity 24/7, meaning they can monitor and report on their financial transactions more effectively.

Fixed rate for same-currency payments: We offered a hard rate for up to 10,000 same-currency payments per month. This fixed fee structure allowed the client’s finance managers to budget effectively, knowing their costs in advance.

Implementation and results

Boosted efficiency: By utilising our File Upload and Bulk Payments features, the payroll provider was able to streamline their payments process to just one hour. This automation replaced a near-week-long manual process, freeing up the team to focus on more strategic tasks.

Cost savings: The fixed rate for same-currency payments provided cost predictability and savings, as the client no longer had to deal with variable fees. This transparent pricing allowed them to plan their finances and budgets more confidently.

Enhanced reporting: The ability to generate and customise reports at any time provided the client with deeper insights into their payment activities. This improved their financial oversight and compliance reporting, making it easier to track transactions and manage audits.

Improved accuracy: Automation reduced the risk of human error in the payment process, ensuring that employees received accurate payments promptly. This reliability helped build trust with the payment provider’s clients by keeping their employees happy.

Conclusion

Using our proprietary technology, we were able to revolutionise the way the business managed the international payroll of their clients.

Our automated, high-tech features elevated their payroll system resulting in significant time savings, cost efficiency, and improved accuracy.

With access to our client portal 24/7, the payroll provider could streamline their operations and focus on their core mission of managing payroll for remote employees globally.

If your business faces similar challenges, contact us to learn how our bespoke financial solutions can transform your payroll processes.