Can I open a UK business bank account as a non-resident?

The short answer is yes, you can open a UK business bank account as a non-resident. However, you may find opening an account tricky depending on who you open one with.

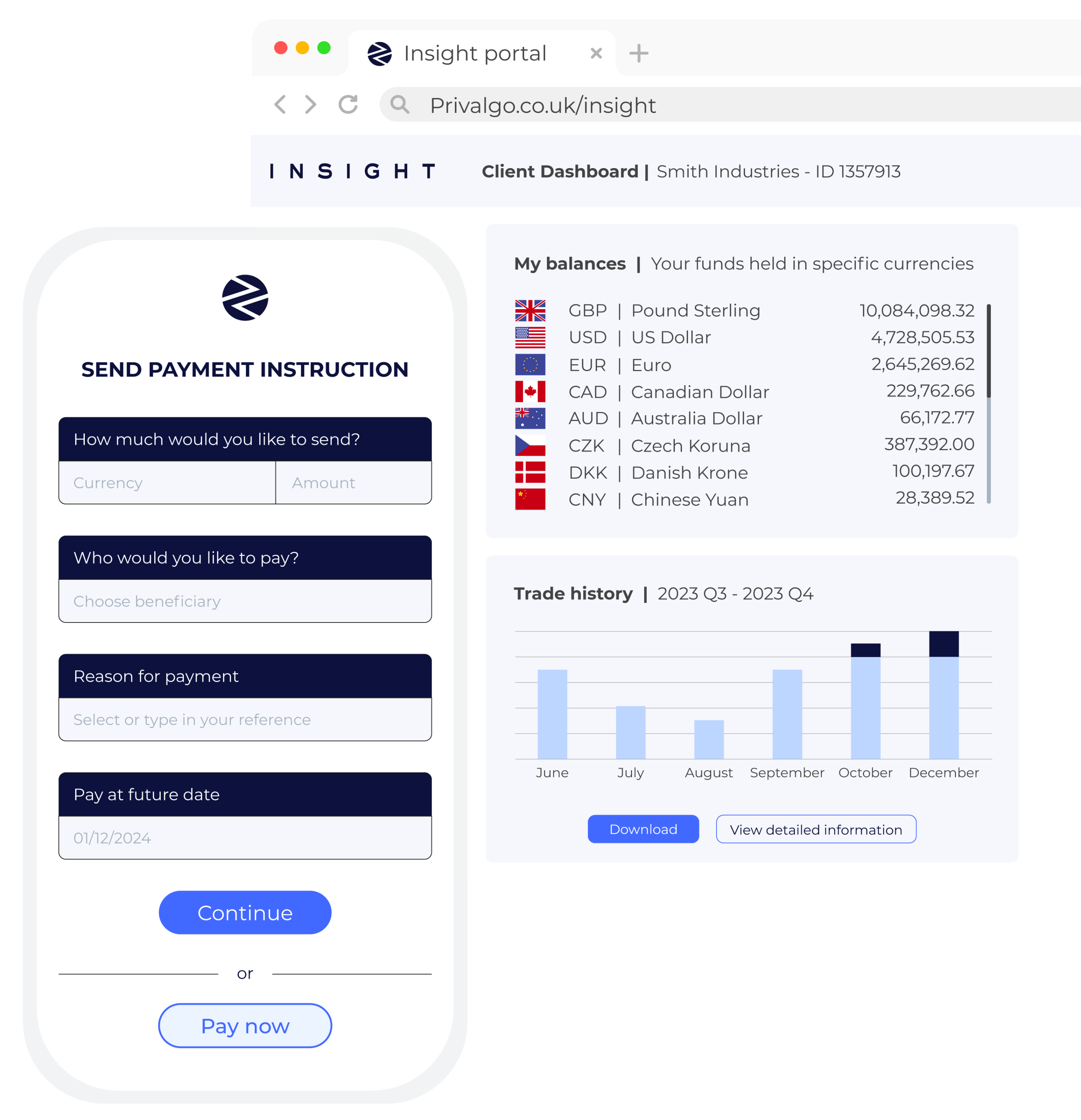

At Privalgo, you can open a multi-currency account for your UK business in as little as 24 hours. You can use this account to send payments in up to 140 currencies, covering 180 countries.

In this article, we’ll discuss why it’s a good idea to have a business account as a non-UK resident and how to open one.

Why do I need a UK business account as a non-resident?

Legally, you don’t have to have a business bank account as a non-resident, but it’s a good idea to have one.

You are required by law under the Companies Act 2006 to provide financial reports that show a true and fair view of your financial performance and position.

Having a bank account dedicated to your UK business will make managing finances a lot clearer and easier.

Benefits of a UK business account

Opening a UK business account means you can make and receive payments faster and easier in the UK.

The following benefits highlight how a UK account can help your business scale internationally quickly.

Simplified international trade

- Multi-currency capabilities: Many UK business bank accounts offer the ability to hold, send, and receive payments in multiple currencies. This is essential when dealing with your international clients and suppliers.

Boosted credibility

- Local presence: Having a UK business account means sharing familiar bank details with UK clients, suppliers, and partners, making you more credible. By having a local presence, you become a more trustworthy business for anyone based in the UK.

Straightforward financial management

- All your UK finances in one place: A UK business account allows you to consolidate your business finances in one online platform, making it easier to manage, monitor and report on your international payments.

Improved currency management

- Hedging options: Some banks offer foreign exchange services that allow you to hedge against currency fluctuations, protecting your business from volatile exchange rates.

Safe and secure

- FCA regulation: UK business accounts are regulated by the Financial Conduct Authority (FCA), meaning they comply with stringent regulations. This ensures your accounts should come with a high level of security and transparency in financial transactions.

Who can I open an account with as a non-resident?

The first step to opening a UK business account as a non-resident is choosing the right provider.

You can open an account through a traditional high-street bank, an online bank, or an electronic money institution (EMI), like Privalgo.

This is a crucial part of the process as financial institutions often have different requirements for opening an account. They might ask you to visit them in person, have long approval times or not accept overseas applications at all.

Since the financial crisis in 2008, UK banks have changed their risk appetites, leaving many non-residents shut out of traditional infrastructure.

This created a range of problems for non-residents looking to open a UK business account including slow application times, rejections without explanations and ambiguous information given by banks.

However, modern banks and fintechs make simple account opening a focal point of their product offering, helping businesses open accounts quickly and easily.

At Privalgo, we help non-residents set up multi-currency business accounts in as little as 24 hours. Here’s how you can open one.

How to open a UK business account as a non-resident

Opening a UK multi-currency business account with Privalgo is quick and easy.

You’ll need most of the same documents required by other providers, but thanks to our fast, comprehensive anti-money laundering (AML) and know-your-customer (KYC) processes you can be up and running in as little as 24 hours.

Here are the documents you’ll need to open an account:

- Proof of identity: Valid passport or national ID card.

- Proof of address: Utility bill, bank statement, or rental agreement from your home country.

- Business documentation: Certificate of incorporation, memorandum and articles of association, and proof of business address.

Once you’ve got your documents to hand, fill in the form below to speak to a member of our team. They’ll guide you through the process and ensure your account is set up and ready to go in no time.

How much does it cost to open an account?

Opening a UK business account with Privalgo is free. It’ll also cost you nothing to keep it open.

There are no hidden fees, and our client portal shows you exactly how much we’re making when you exchange currencies. This ensures our rates are clear and totally transparent.

International payments made using SWIFT from the UK will infer a fee. We’ll communicate this fee to you directly. Fees can range from £5 to £30 per payment depending on which country your payment’s heading to.

Why open a business account with Privalgo?

Receive, hold and send funds from one state-of-the-art platform.

- Customise and download financial reports to analyse specific data at any time.

- Access up to 140 currencies for payments to 180 countries.

- Open a multi-currency account in your business name in 24 hours.

- Human support from a dedicated person

Get started

Receive, hold and send funds from one state-of-the-art platform.

Receive, hold and send funds from one state-of-the-art platform.