Business owners will know that selling to existing customers is easier than acquiring new ones. Customer acquisition is an expensive process, so companies want to ensure maximum return on their investment.

This is why many businesses benefit from calculating the lifetime value of a client. They can do this through a metric called Customer Lifetime Value (CLV).

Understanding CLV can help companies acquire and maintain customers. The data it creates can shape customer support and loyalty strategies and influence business decisions.

In this article, we’re investigating the benefits of CLV, how to work it out and some of the models business managers can use.

What are the benefits of Customer Lifetime Value?

CLV can be a vital tool for decision makers looking to identify and target the company’s most valuable customer segments. Here are some of the benefits it brings.

Boosted revenue

Companies earn money from repeated business, whether the customer’s transactions are big or small. By extending the lifespan of a client relationship, businesses are bringing in more revenue.

CLV helps companies highlight their most valuable customers. They can then tailor their products and/or services to these customers, keeping them satisfied. The happier the customers, the more likely they are to come back.

Increased customer loyalty

Businesses work hard to acquire customers, so keeping hold of them is crucial. Managing CLV can highlight negative trends and provoke businesses to rethink their approach.

To help elevate CLV, companies can reshape their customer support strategies and loyalty programs to better meet customer needs. Clients who receive desirable support and incentive to return may be more likely to spend again.

Lower acquisition costs

According to Invesp, customer acquisition is five times more expensive than retention. Furthermore, it suggests increasing customer retention rates by 5% can boost profits by 25% to 95%.

These stats highlight the importance for businesses to pinpoint and nurture their most valuable clients. Through CLV, companies can maximise the value of customer retention and rely less on big-budget acquisition strategies.

Let’s look at how it works.

Customer Lifetime Value calculation

The equation for calculating CLV is Customer Value multiplied by Average Customer Lifespan. We can work it out using formulas. Let’s break it down.

Customer Lifetime Value formulas

The equation for CLV uses two key parts. First is Customer Value (CV) which also needs to be calculated.

To do this, we multiply Average Purchase Value (APV) by Average Purchase Frequency (APF). Here’s how we work it out.

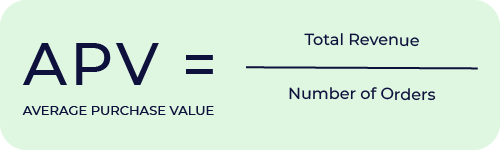

Average Purchase Value (APV)

To calculate APV, we must divide the total revenue of a business over a period by the number of purchases in that period.

Let’s say a business’s yearly revenue is £1,000,000. During that year, they receive 50,000 orders. This means APV is £20.

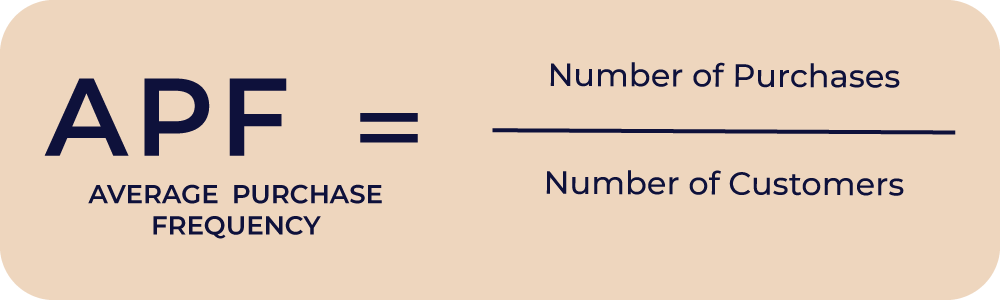

Average Purchase Frequency (AVF)

In part two of our Customer Value equation, we need to work out APF. To do this, we divide the number of purchases in a period by the number of unique customers.

In our previous example, the number of purchases a business received in one year was 50,000. If the purchases were made by 5,000 different customers, APF would be 10.

Customer Value (CV)

Now we know how to calculate APV and APF, we can find our CV figure. As mentioned earlier, CV is equal to APV multiplied by APF.

Using our example, the business had an APV of £20 and an APFR of 10. Therefore, the CV is £200.

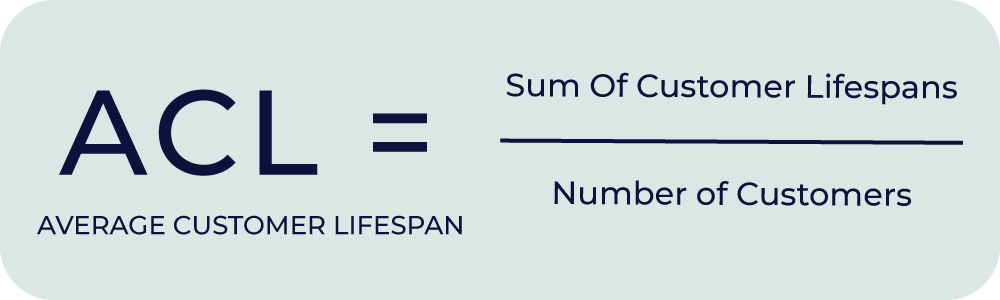

Average Customer Lifespan (ACL)

To complete the CLV equation, we have to figure out Average Customer Lifespan (ACL). Firstly, we tally the number of days between the first and last purchases of all customers.

Customer 1: First purchase is made on 24/02/2019. Last purchase is made on 28/09/2021. Total number of days between purchases is 947.

Customer 2: First purchase is made on 18/04/2019. Last purchase is made on 29/09/2021. Total number of days between purchases is 853.

Customer 3: First purchase is made 26/02/2019. Last purchase is made on 28/02/2021. Total number of days between purchases is 732.

We now combine the total number of days of all three customers to make 2532. This is then divided by the number of customers (three) to give us 844. To make this more digestible, we divide the total by 365 to give us a figure in years. In this case, 2.3 years.

Customer Lifetime Value models

There are multiple models businesses can use to calculate CLV. They can be split into two approaches: predictive and historical.

Predictive customer lifetime value

As the name suggests, the predictive approach attempts to predict the future behaviour of customers. There are two models businesses can use. One is the Machine Learning Model (MLM) and the other is the Probabilistic Model (PM).

The MLM uses algorithms to find patterns in past data. If the data feeding the algorithms is accurate, it can be hugely effective at predicting future customer behaviour. This means data such as duplicate customers and empty fields must be removed beforehand.

The machine learning process can estimate each customer’s average order amount, lifespan with the company and their purchase frequency.

There are various probabilistic models under the PM umbrella that can be used to predict CLV. The models fit a probability distribution to different aspects of the CLV equation.

Historical customer lifetime value

Under the historical approach to CLV, we have the Aggregate Model (AM) and the Cohort Model (CM).

The AM is perhaps the most common model used by businesses. It calculates CLV through the average revenue of each customer based on their previous transactions.

This method creates a single value for CLV, which has its drawbacks. For one, it groups all customers together potentially leading to unreliable data.

For instance, a company might see a higher churn rate due to seasonality or fluctuations in the monetary value of orders when ‘big spenders’ pay a visit. These factors can influence the overall customer value.

In contrast, the CM groups customers based on their transaction dates. Typically, customers are separated into cohorts for different months of the year depending on their initial purchase date.

The idea is that customers sharing a cohort have similar spending or behaviour patterns. From this, a value for CLV is generated for each cohort.

The benefits of mitigating financial risk

CLV helps companies target their most valuable customers, saving money on acquisition and maximising retention earnings.

It also minimises the risks of making incorrect assumptions about future customer behaviour, potentially damaging a business’s forecasting.

Similarly, companies that make international payments can mitigate the risks of currency market volatility with an effective foreign exchange (FX) strategy.

At Privalgo, we help businesses create unique FX strategies based on their needs – protecting their money from market movements.

Get in touch with a Privalgo Foreign Exchange Specialist to discover how we can help.