What are virtual IBANs for business?

Businesses have been looking for ways to streamline their cross-border payments for years. And in virtual IBANs, they may have found their answer.

Traditionally, managing international cashflows is a resource-heavy, time-consuming process. Through virtual IBAN accounts, businesses can improve efficiency, increase control and cut costs.

In this article, we’ll be explaining what virtual IBANs are, how they work and how they can benefit businesses.

What’s the difference between a virtual IBAN and a traditional IBAN?

An IBAN is a unique code used for identifying bank accounts when sending and receiving international transfers.

In the UK, bank accounts give you an account number and a sort code to make domestic payments. An IBAN works in the same way for international transfers.

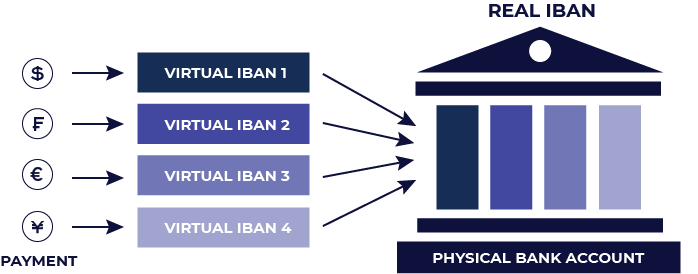

IBANs are matched directly to a bank account. You have one IBAN to one bank account. Virtual IBANs (vIBANs) are different.

You can have multiple vIBANs linking to the same central bank account. Think of vIBANs as sub accounts of a master central account.

If you send and receive international payments from lots of different entities, you’ll have to provide them with an IBAN and additional reference information. This is so you can track where a payment has come from.

Virtual IBAN accounts are loaded with referencing information that makes international payments easy. By distributing unique vIBANs to your payees, they’ll no longer need to add anything when they transfer money to your business.

The payment will be rerouted to your physical bank account, and you’ll know exactly where the money has come from.

How do virtual IBANs work?

If you send and receive international payments from lots of different entities, you’ll have to provide them with an IBAN and additional reference information. This is so you can track where a payment has come from.

Virtual IBAN accounts contain referencing information to make international payments easy. By distributing unique vIBANs to your payees, they’ll no longer need to add anything when they transfer money to your business.

The payment will be rerouted to your main account, and you’ll know exactly where the money has come from.

Think of it as:

- One unique virtual IBAN

- One central account

- No extra referencing needed

What are the advantages of virtual IBANs?

Virtual IBANs can help businesses save money on their cross-border payments.

For business operating internationally, opening bank accounts in foreign countries to settle payments can be expensive and time consuming.

Through vIBANs, businesses experience the same settlement capabilities without the need for individual accounts.

As they operate virtually, vIBAN accounts are quick and easy to set up; they take little time and don’t require you or your business to reside in the same country as your account provider.

Who benefits from virtual IBANs?

Virtual IBANs are ideal for businesses that:

- Send or receive frequent cross-border payments

- Operate across multiple regions

- Work with international suppliers and customers

- Manage marketplace payouts (e.g., Amazon sellers, online platforms)

- Need to track payments across different entities or departments

Making international payments with virtual IBANs

International businesses use virtual IBANs for their convenience and cost-cutting abilities.

They lead to:

- Faster account setup compared to traditional banks

- Lower costs by avoiding multiple physical accounts

- Easier reconciliation of incoming payments

- Improved cash flow management across currencies

- Simplified international expansion without local banking setups

At Privalgo, we can provide virtual IBANs for your business at speed, streamlining your processes.

Speak with one a Privalgo Currency Specialist today to find out how a virtual IBAN can save you time, money and admin — while keeping your international business moving forward.

10 FAQS about virtual IBANs

Below are 10 frequently asked questions about vIBANs. Some of the answers use content already discussed in this article.

What is a virtual IBAN?

A virtual IBAN (vIBAN) is a unique account number that routes payments to a central bank account. It works like a sub-account, allowing businesses to assign different vIBANs to customers, suppliers or departments for easier tracking and reconciliation.

What is the difference between a virtual and physical IBAN?

A physical IBAN is directly linked to a single, traditional bank account. A virtual IBAN is not a standalone bank account—it links to a master account, allowing multiple vIBANs to feed into one central place for better control and visibility.

How do I identify a virtual IBAN?

To the payer, a virtual IBAN looks like a standard IBAN. Internally, it’s recognised as routing to a central account. Businesses manage and track virtual IBANs via their payment provider’s platform, rather than through a traditional bank branch.

What is the difference between a real account and a virtual account?

A real (physical) account is a fully functional bank account held at a financial institution. A virtual account—like a vIBAN—acts as a digital layer on top of a real account, offering unique identifiers without requiring multiple physical setups.

What are the benefits of using a virtual IBAN?

Virtual IBANs help reduce banking costs, simplify reconciliation, accelerate account setup, and eliminate the need for opening multiple foreign bank accounts. They’re especially useful for businesses managing international payments at scale.

Who should use virtual IBANs?

Virtual IBANs are ideal for businesses with global operations, frequent cross-border transactions, or a need to segregate incoming payments by customer, department, or geography.

Are virtual IBANs secure?

Yes. vIBANs are issued by financial providers and operate under the same banking standards as physical IBANs.

Can I receive multiple currencies with a virtual IBAN?

Yes. Virtual IBANs can be created in multiple currencies, allowing you to receive local or foreign currency payments efficiently—often without unnecessary conversion or intermediary fees.

How quickly can I set up a virtual IBAN?

Unlike traditional bank accounts, virtual IBANs can often be set up at high speed. There’s no need for a local branch visit or residency in the country of issuance.

How can Privalgo help with virtual IBANs?

Privalgo offers virtual IBANs linked to multi-currency accounts, helping your business receive and manage international payments more efficiently. Our Currency Specialists work with you to set up the right structure for your operations.