Environmental social governance (ESG) has become a top priority for today’s businesses. Why? Because ESG shows commitment to an increasingly valued modern corporate target: sustainability.

Governing bodies from around the world have put pressure on businesses to become more sustainable. Since 2021, we’ve seen fresh sustainability regulations in the US, EU and UK.

In response, businesses are re-evaluating their processes to meet ESG demands. This means digging deep and finding ways to implement sustainable operations.

With all departments going under the microscope, we’re looking into the impact of ESG on the modern treasurer.

ESG meaning

ESG and sustainability go hand in hand. Put simply, businesses look to achieve a high ESG score by meeting a set of criteria. The higher their score, the more sustainable they can claim to be.

Let’s break down how it works.

As the first letter in the acronym suggests, businesses are measured on how they impact the environment. They can be assessed on both their policies and actions. For example, their climate change policies may be investigated as well as their energy usage and waste production.

The social aspect focuses on how businesses manage their relationship with employees, suppliers and clients. Also, their relationship with the surrounding community may affect their ESG score.

Lastly, businesses are analysed on their governance. This delves into a business’s systems and controls, such as transparency, leadership, executive pay, audits, compliance, communication with regulators and shareholder rights.

What role do finance and treasury play in ESG?

Businesses with sustainability goals will think about how each department can contribute to ESG. And finance is no exception.

Fundamentally, ESG wants businesses to make responsible choices: ones that benefit the world around them and improve their longevity. As finance is a key part of any business, ESG has become a top challenge for today’s corporate treasurers and finance managers.

Here are some of the ways they can play their part.

Responsible finance and investments

One of treasury’s main roles in sustainability is to conduct responsible finance and investments. They must hold their own business to account, introducing KPIs and audits to ensure ESG targets are being met.

When it comes to spending, treasurers can critique their supply chain using an ESG scoring mechanism. They can use this to assess their suppliers and the businesses and people they invest in on their sustainable behaviour. Based on performance, they can create a preferred suppliers list – putting pressure on suppliers to comply with their targets.

For example, a fund buying shares in a company may factor in the social repercussions of its purchase. Does the company have an ethnically diverse culture and suitable working conditions?

Or if a business purchases car parts from a supplier, what is the environmental impact? Does the manufacturer selling the parts have a low carbon footprint?

Similarly, treasurers might look at how a business is governed. For instance, they may prioritise businesses that openly report board evaluations or promote a culture of fair competition.

By setting an ESG standard for their trading partners, treasurers can be confident they’re spending sustainably.

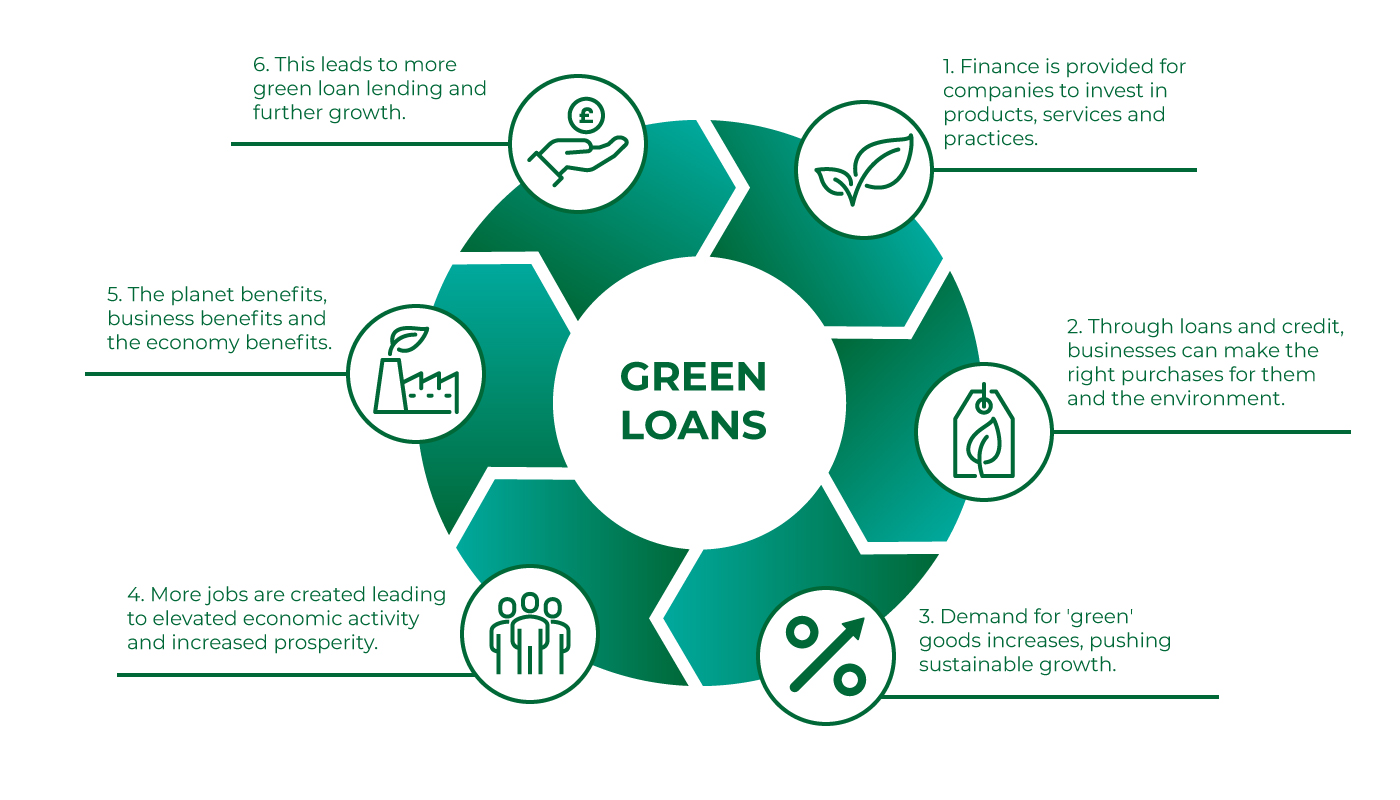

Also, we’re already seeing financial products start to favour more sustainable businesses. For example, some banks offer green loans or sustainably-linked loans to businesses that meet certain criteria.

These are used to help companies and individuals invest in modern technologies and switch to more sustainable practices. Treasurers can use green loans to improve business processes and make them more eco-friendly.

The image below shows the benefits of green loans and why banks offer them.

Greener processes

As businesses make the digital shift, modern treasurers can say goodbye to paper and hello to greener processes.

Today’s finance managers have plenty of digital systems at their fingertips. We’re seeing robotic process automation (RPA), artificial intelligence (AI), cloud platforms, and plenty more become easily accessible and an integral part of business function.

These systems allow treasurers to see payments in real time, improve forecasting, manage expenses more easily and cut costs. And while they benefit business functionality, they help the planet, too.

By removing the need for manual processes and paper records, finance managers are conducting ‘greener’ activities. Additionally, the use of initiatives like open banking are favoured by ESG for encouraging transparency.

Compliance and risk management

Treasury plays a crucial role in managing risk and staying up to date with regulatory changes.

There are lots to keep an eye on, including problems with counterparties, settlements and cyber security. Finance departments must have the right systems in place to manage and handle any issues that arise.

It’s also imperative that businesses comply with the latest industry regulations. In the last few years, we’ve seen regulatory scrutiny around ESG and sustainability ramp up.

For instance, the EU introduced the EU taxonomy for sustainable activities in July 2020. It aims to encourage greener investments and prevent greenwashing (this is when a business falsely claims its products are environmentally friendly).

Also, regulatory bodies are requesting regular reports from institutions for green loans. They want to see relevant documentation showing how lenders evaluate and select projects. By doing so, regulators reduce the risk of green loans finding their way into unsuitable hands.

Today’s treasurers have to stay on top of these kinds of changes. To do so, they need data governance mechanisms that automate regulatory and tax reporting.

To ensure this happens fluidly, it’s important they have strong relationships with banks and third parties. This will enable them to stay updated with the latest regulations and deploy the right digital tools for automation.

Why is ESG important to consumers?

Sustainability has never been more in the limelight. And the pressure on business leaders to cooperate continues to mount.

In response, we’re starting to see businesses everywhere commit to ESG goals. Whether it’s to achieve a net-zero carbon footprint or to reduce waste by a small percentage, companies are willing to set ESG targets.

For consumers, this is just the beginning. And there’s always demand for more. So much so that high-scoring ESG companies are starting to take preference over those that score poorly.

According to research from IBM, 54% of consumers are willing to pay a premium for goods from sustainable brands. The same study also found that 71% of employees and job seekers would rather work for sustainable companies.

Additionally, findings from PWC’s 2021 Consumer Intelligence Series survey on ESG show that consumers are more likely to buy from companies that stand up for environmental (80%), social (76%) and governance (80%) issues.

But why do consumers care about ESG? Well, consumers have valued sustainability for a long time.

Climate change has always been high on the list, so corporate action with a positive outcome for the environment is a winner.

Also, the Covid-19 pandemic may have inspired consumers to change the way they think about sustainability.

The economic fallout meant people started to care more about business governance. Now, there’s increasing demand for companies to implement robust systems designed to mitigate risk and take shocks from unexpected black swan events.

The value of transparency

Much like the aftereffects of the Covid-19 pandemic, the financial crisis of 2008 changed how consumers value transparency.

It has since become an integral part of any business, especially those within financial services. Without a transparent approach, consumers struggle to trust the companies they deal with.

At Privalgo, transparency is one of our core values. We hide no fees and always show our clients how much we make from their trades. This way, they know we’re not pulling the wool over their eyes with honeymoon rates.

To find out how our transparent pricing could help your business, book a chat with a Privalgo Foreign Exchange Specialist today.