Cable (GBP/USD), like nearly all currencies during this time, has been extremely volatile. In this article, we examine what is currently moving cable and give our view on what’s install next?

Calm before the Storm

Before the Coronavirus reached the UK, GBP/USD was sitting steadily around the 1.30 handle in a fairly tight, four-cent range. The UK had left the EU and all GBP investors were focusing on was Boris Johnson’s negotiating tactic for a trade deal with the economic block.

This quickly changed as Boris Johnson and the majority of developed Western nations took significant measures to prevent our healthcare systems from being overwhelmed by COVID-19. Most developed nations entered full lockdown and stock markets crashed in a fashion not seen since the 2008 financial crisis. To exacerbated issues, Saudi Arabia announced they would be increasing oil production in order to spite the Russians and drive the price of oil lower.

So What?

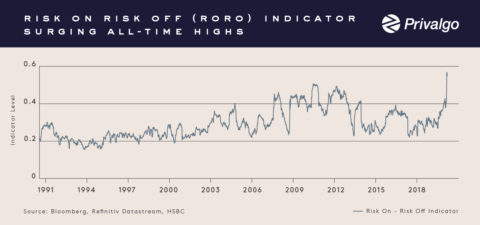

The ‘Risk On-Risk Off’ (RORO) sentiment still seems to be the dominant force in FX, with markets paying relatively less attention to the differences between various policy responses announced to combat any economic fallout.

This has been the biggest driver in GBP/USD volatility since the emergence of Coronavirus. The Pound has moved into the ‘risk-on’ bucket, possibly because of Brexit and the economy’s gradually softening ties with the big, closed economy of the Eurozone.

What’s Next?

At the height of the market uncertainty seen last month, GBP/USD touched a low of 1.1410. With the ‘RORO’ indicator at record highs, you would expect ‘risk-off’ safe haven currencies such as the USD & JPY to continue to outperform ‘risk-on’ currencies in this current environment. Emerging market currencies as well as AUD, NZD, NOK and unfortunately GBP will continue to struggle.